Offer international and local payment methods

International payment methods are very different and specific to each country. So much so that some payment methods only exist in certain countries. For instance, for our Belgian neighbors, Bancontact / Mistercash are used for over 60% of online payments, while Alipay makes up for 35% of transactions in China. No two countries are alike, each one has its own characteristics and payment conditions.

Payment means

Currency management

When foreign currency payments account for more than 5% of your company’s turnover, Lyra allows you to collect your foreign currency payments. This allows you to avoid euro conversion fees and, if you ever need to pay your bills in this currency, you will be able to use the collected funds to do so.

If the volume of the collected foreign currencies represents less than 5% of your turnover, we take care of the conversion and the capture of the funds in euros.

GOOD TO KNOW : Transactions with the United Kingdom and the French Overseas Territories should be considered as international transactions (costs outside the euro area).

Language management

Designed to support your international expansion, our interfaces and payment paths are available in several languages. This will simplify the deployment of your site in new markets.

Wherever you are, depending on the needs of your teams or to better understand the market in which you are evolving, you can easily change the display language and offer a perfectly customized payment path.

To succeed, it is essential to rely on a solution for streamlining your operations that is adapted to the international market.

Samuel Galloo, CEO

HYPNIA

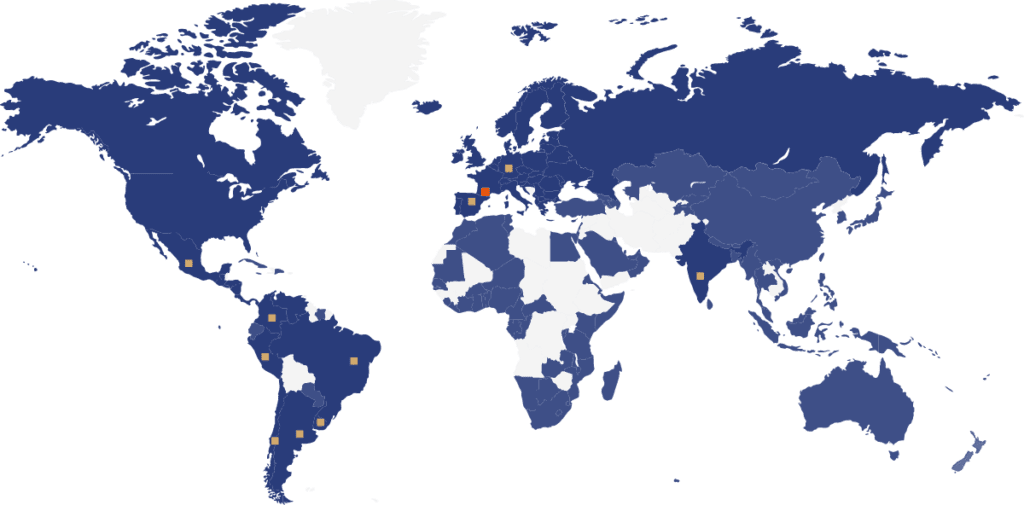

A global coverage for a local presence

Because your buyers can pay from anywhere, our services are also global.

A single dashboard for navigating the world

Get a three-dimensional view of your business. The Lyra dashboard provides detailed information about your business and payments with its analysis and statistics modules. The amounts and volumes of your transactions, refunds and even the payment methods used for the transactions: it’s all there!

Monitor your performance with an extensive set of indicators. Assess your gross and net acceptance rate with a complete breakdown of each activity.

Each user gets a personalized dashboard tailored to their needs. You can resize the charts and change their position with a simple drag and drop.

Simplified integration for your deployment

You can freely access all our resources to facilitate your integration and take advantage of our GitHub account for our code examples. For custom integration, our APIs are designed to directly work with your own tools.

You can also discover our advanced features for managing large volumes of data (Batch & Web Services).