Payment Gateways are being embraced

Over a period, payment gateways have gained immense popularity among the masses as they provide basic ease, convenience, and security with transactions.

Lately, so much is happening in favor of the online payments that people are embracing payment gateway like never before:

Number 1, majorly, is the favorable regulatory environment, which has played an integral role.

After having observed the elevating status of online payments, authoritative bodies/governments have inflicted several factors to keep up with the pacing technology and dynamic customer outlook.

To do justice to the dynamism of the online payments industry, the concerned bodies keep introducing new decisions.

Policies like KYC relaxation for small transactions, elimination of 2-factor authentications, and promotion of cashless transactions have provided a further nudge to digital payments.

Number 2, Enhanced customer experience leads to more satisfied customers, and hence, makes the customers inclined to the same in particular.

Ever since e-commerce platforms have become popular in India, people have significantly become frequent online shoppers.

In making online shopping popular, exceptional customer experience undoubtedly receives a major chunk of the credit.

There is a whole lot of convenience in placing the order online, receiving it while sitting at home, and getting it exchanged/returned.

Payment gateways have only added to the advantages with seamless transaction flow, exceptional security, and hassle-free payments.

Hence, enhanced customer satisfaction/experience is another important factor for the enhanced functioning of the payment gateway.

Number 3, Growth in the e-commerce segment lately has picked payment gateway’s growth parallel to its own.

Since e-commerce platforms make use of payment gateway for providing their customers with a method of making payments that are quick, convenient, and safe, they play an imperative role.

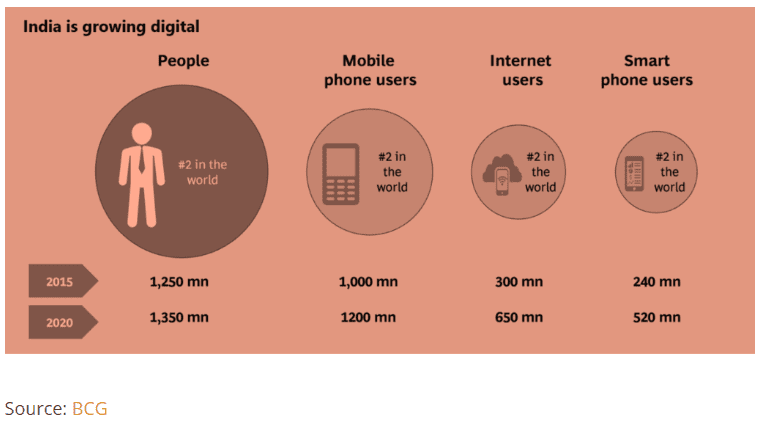

Number 4, India is becoming Digital, which is visible in the recent progress of the country in terms of shifting to digital methods of payment.

It has led to an increase in the demand for better opportunities consequently. In terms of mobile subscriptions, India has come out ranking second with around 1 billion mobile subscriptions.

Around 240 million use smartphones and it is predicted that it will rise to around 520 million by 2020. Similarly, as 3G 4G penetration has increased considerably, the number of internet users is also predicted to double to 650 million by 2020.

As the demands of the country are increasing for digital payments, it is but obvious that the regulatory bodies and concerned industries will go on to rapidly meet the concerns similarly.

According to the Future Market Insights (FMI) report, the global online payment gateway market is expected to witness a CAGR of 10.3% from 2018 to 2028.

The market is expected to reach a valuation of US$ 191.7 Billion by the end of the forecast period rising from a valuation of $ 65.5 Billion in 2017

In what ways has the Payment Gateway become Accessible to End-Users and Efficient for Merchants specifically:

As dynamism has progressed through d the advancement of the f online payments sector, it is obvious that its accessibility to the end-users and efficiency for merchants have both gone up.

Take a look below at how the strong growth trajectory has turned it all for the better:

For end-users,

Apart from the evolving (and progressing) nature of payment gateways, end-users are enjoying the benefits in several other ways:

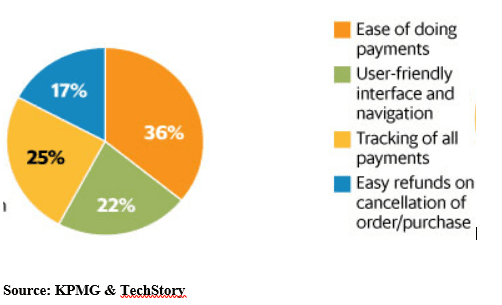

- With increased ease of doing payments

- Access to a user-friendly interface and navigation

- Enabling of tracker for all payments

- Much more ease with the quicker refunds on cancellation of order/purchase

Now, let’s see how the aforementioned benefits are helping how many of the population approximately-

For merchants,

Since payment gateways are progressing majorly to provide added benefits to the merchants, below are the main areas that have developed to increase the efficiency:

- Increased security with transactions

With PCI-DSS compliant servers, the transactions of the merchants are successfully compliant with the security that a bank can deliver to the masses.

Furthermore, Lyra Payment gateway recently achieved the title of being EMV 3D S 2.1. These security measures have, consequently, increased payment gateways’ efficiency considerably.

- Less time & effort spent

Bringing down the tedious tasks of preparing payments and managing payment issues, payment gateways have significantly brought down the level of time & efforts taken earlier.

A payment gateway does not require anything since it is equipped with a by-default setting. This setting helps with the processing of continuous payments and reduces the cost alongside.

- Quicker and smoother transactions

Any advancement or progress in technology happens to make the circumstances better than before. Now, the provisions, like KYC, one-click payments, wallets, quick onboarding, and so many other features have combined to make transactions even quicker for merchants.

Their automated ways and systematically designed platforms lead to an increase in the conversion rates for furthering sales.

Lyra’s Payment Gateway:

Lyra Payment Gateway, the online solution powered by Lyra, is devised for making the customers’ online payments path uniform with each transaction.

Featuring an innovative payment platform, Lyra’s payment gateway provides a high level of security. It offers several features namely, hassle-free, secure, convenient, and smooth flow of transactions.

Committing an enhanced success rate to the merchants, widens the arena of selling as well as comfort. Besides, it has the backing of French technical support, which ensures payment methods like wallet payments, multi-card payments, and split payments.

Supplementing the provisions is the zero setup fee and no maintenance fee to aid the merchants with a cost-effective solution.

Payment Methods:

- Manual Payment

- Payment via e-mail and SMS

- EMI Payment Options

- Split Payment

- 1-Click-check-out

- Multi-card payments

- Debit, Credit card, and net banking options

- Wallet payments

Features of Lyra Payment Gateway:

- Certified with Visa and MasterCard, Amex, and Diners.

- Provides proven real-time Card authentication solution.

- Renders simple merchant integration.

- Offers multi-platform support.

- Enables the bank to view 3DS-related communication in real-time using the Lyra web portal.

- Provides the issuer ACS URL immediately on the portal whenever ACS is down.

Benefits of Lyra Payment Gateway:

- Higher success rate and conversion rate

- Maximum security with 3DS transactions

- Seamless integration

- Fraud and Chargeback minimization

- Maintains transaction integrity