Online purchase of goods, solutions, and services has revolutionized commerce, opening countless opportunities to entrepreneurs worldwide. As commerce or more importantly e-commerce continues to broaden, it has also opened doors to online fraud and theft.

Online payment security is becoming one of the most serious issues. Protecting customers against attacks over the internet and cyber theft to gain their trust is becoming very crucial and one of the most important tasks for business owners.

For business owners, it is important to take maximum security measures to keep their business as well as their customers safe from the risks in accepting online payments.

If a customer is trusting an online business with their money and information for a purchase, it is a merchant’s responsibility to maintain that trust and provide them with a secure and seamless buying experience.

The online payment fraud rate is increasing at an alarming rate and it will keep on increasing.

As baffling as it is, according to a report, over 5500 cases of fraud have been reported in the last financial year.

What is Payment Security?

Online payment security can be considered as providing rules, regulations, and security measures to protect customers’ privacy, data, and the money involved.

In this digital era, every business, company needs to look out for every hazard, every problem that can be faced through cyber attacks, as it can occur as quickly as clicking on an email link.

So, what are the security protocols and processes you should look for, every time you transact online? How to defend against online breaches in online payment security? Are there any best ways to improve online security?

What is EMVCO 3DS secure 2.0

What is EMVCo 3DS 2.0? For elevated security to the end customers as well as merchants with regard to their daily transactions, EMVCo 3D Secure...

Here are some measures, businesses can take:

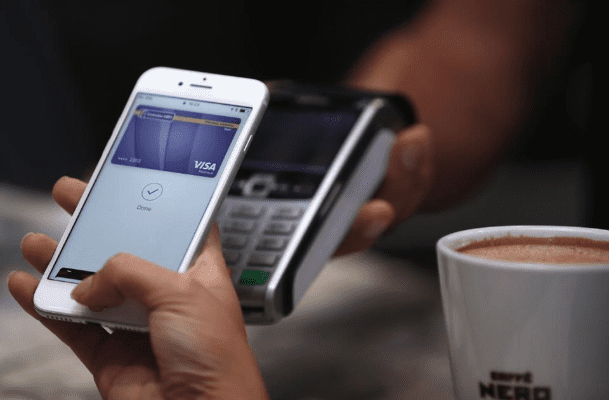

Partner with a Processor who knows Online Payments

Online payment security starts with your online payment processor. Choosing the right payment processing partner which prioritizes security for accepting online payments is the first step to business safety.

Consultation with payment experts and opting out for an experienced online payment processing partner will certainly provide a good edge over the payment security breach. Choosing the right online payment processing partner, who can understand business needs and can craft an online payment acceptance solution with security measures is extremely important.

Also, it is important to check and make sure that your website host is providing Secure Socket Layer protection to encrypt any data inputted into your site

Monitoring suspicious activities – Online Payments and Purchasing

As an owner of the business, doing your research is a must. You have to be aware of suspicious activities that could initiate fraud.

According to the research, there is always a pattern when it comes to online fraud. It can be multiple purchases from the same IP but from different cards or uncommon large purchases. Whether your payment processor has his security checks in place, sometimes a fraudulent order can slip through.

So, once you start to recognize the pattern have detailed research and training on it, it becomes easier to recognize those. Though the single point of activity may not make it suspicious enough to identify as a fraud, multiple data points with a trained model can certainly help.

Educate Users and Employees about the Importance of Payment Security

It is essential to create general awareness among people about online security and fraud. Precaution is always better than cure. An aware customer and equally trained employee can be considered as one of the key points to fraud minimization.

In addition to the awareness within employees, a business owner should also be familiar with government schemes and regulations to prevent fraud.

How 3DS payment gateway has affected Ecommerce industry in India

3DS (3 Domain Secure) forms one of the most innovative births in the family of online payments. The protocol developed by VISA to improve online...

Here are some Compliance’s to look for in Payment Processing provide

Encryption:

Encryption is a method to conceal the information in the string of codes that appears as random data which is complex to decode. Encryption is one of the methods which is essential for the safety and security of transmitting data.

There are various techniques for encryption. The choice of these techniques depends on the type and context of the requirement for data transmission. Some of the common encryption techniques used in e-commerce are:

- Public key encryption

- Symmetric key encryption

Secure Socket Layer (SSL):

SSL or Secured Socket Layer is the most widely deployed and used security measure that provides security over internet communications.SSL provides a secure communication layer between machines operating online.SSL supports security protocols like Encryption, Authentication and it makes sure that requested and submitted data actually gets delivered.

SSL certification can be used to secure all types of online transactions (credit, debit card, online banking, etc.). SSL protocol is developed to prevent online security breaches while transmitting data online.

Secure Hypertext Transfer Protocol (S-HTTP):

S-HTTP or Secure Hypertext Transfer Protocol is an extension of Hypertext Transfer Protocol allowing the secure exchange of files over the internet. S-HTTP provides enhanced online security that allows the client to send a certificate to authenticate the user using public-key encryption and digital signatures.

S-HTTP secured website integrates seamlessly with HTTP providing endpoint security making online transactions more secure.

How to Test your Payment Gateway Integration

Importance and Intricacies of Testing the integration of Payment Gateway Considering the importance of a payment gateway for any e-commerce...

Secure Electronic Transaction (SET)

SET or Secure Electronic Transaction is a collaboration by MasterCard and VISA that ensures the safety of all entities involved in electronic payments transactions. It handles critical functions like:

- Authenticating the cardholders and merchants

- Confidentiality of information and payment data

- Define protocols & electronic security service, providers

Payment Card Industry (PCI) Compliance

PCI DSS i.e. Payment Card Industry Data Security Standard is a set of security regulations developed by Visa, MasterCard, Discover Financial Services, JCB International, and American Express in 2004.

They set operational and technical standards for firms accepting or processing online technical transactions, and for software developers and manufacturers of applications and devices used in those transactions.

The protocol is made for any entity that deals with the accepting, processing, storing, and transmitting credit card information. With the main goal of maintaining a secure environment for sensitive card details, it helps to decrease fraud or online security breaches.

It is mandatory for every business owner that plans to accept online payment to know PCI DSS standards thoroughly.

Learn More About PCI DSS Compliance

PCI DSS goals:

- Cardholder data protection

- Vulnerability management program maintenance

- Regular networks’ monitoring and testing

- Secure network & system maintenance

- Information security policy maintenance

- Strict access control measures implementation

More Precautions

As they say, prevention is better than a cure. Here are some of the precautions which every business should take.

Safe Login Screen

The security of the eCommerce website starts with the login page. It is extremely important to have a website that is user-friendly and stores customer data securely. The Safe login screen is essential in order to prevent hackers from getting sensitive information and thus warding off the fraud and threats

Digital Signature

A digital signature provides a unique identity to your message. It is specifically used for verification purposes. It maintains the authority and confidentiality of the data and doesn’t allow any alteration.

Address verification system for all transaction

The Address verification system is necessary in order to analyze the person making the purchase and a cardholder are the same or not. This fraud can be prevented by many techniques. This system generally checks and compares the billing address with the cardholder’s details. However, the incorrect address does not necessarily mean a theft, this tool is without a doubt one of the best tools to identify fraud. It generally uses CVV2 identification.

Two-factor authentication

2FA gives a more sophisticated level of protection. This authorization is mainly used while entering an account. 2FA adds an extra layer of security that can be used to make sure that people trying to gain access to an online account are who they say they are. As the name suggests, it provides two different authentication factors to verify themselves, for example, it includes security questions, SMS messages, OTPs, pushes notifications, etc.

How Credit Card Fraud Can Be Prevented with Merchant Plug-In

How Credit Card Fraud Can Be Prevented with Merchant Plug-In Lyra MPI has become even easier to keep credit card fraud at bay and provide the...

Tokenization

One of the most secure ways used for online credit card payment is tokenization. Tokenization replaces sensitive data with a sequence of randomly generated numbers known as a token.

Tokenization is a pretty complicated process that makes it near to impossible to hack. Every store uses a different token to protect credit card data.

Why does the tokenization rule?

All-in-all, due to increasing cybercrimes, it is extremely important for businesses to have state-of-art methods for accepting online payments securely. Businesses need enhanced payment security measures which can be done by combining the aforementioned ways.

Lyra is providing a secure payment solution tailor-made for your business. Feel free to contact us and get a secure payment collection for your business.

Lyra, Accompanying You to Offer Secure Online Payments

Boost Your Business

Let us help you find the best Payment Solution for your Business