ecommerce fraud called payment fraud and is basically any type of illegal or false transaction.

Ecommerce is undoubtedly the biggest part and contributor in online business. Day by day the eCommerce sector is evolving, getting more influence and growing revenues.

But unfortunately, growing revenues comes with the price of increasing fraud. As of today, one of the most concerning things for eCommerce businesses is online fraud.

As a merchant, if you are running an eCommerce business it is necessary for you to take precautions against online fraud.

What Is E-commerce Fraud?

eCommerce fraud is an illegal transaction performed on an eCommerce platform by a criminal or fraudster by using stolen payment information for online transactions without the account owner’s knowledge. It is also known as purchase fraud. It can be done by using a false identity, stolen credit card, fake cards, and details, false personal and card information, etc.

Why Does the Online Fraud Take Place?

It is rather obvious that the growth of the eCommerce industry, along with the increase in payment methods like cards, online payment solutions are directly linked to the increase in frauds.

According to the report, eCommerce fraud numbers have grown rapidly over the last few years making online frauds twice the rate of eCommerce sales.

The chargeback rate is increasing near to 20% each year. The number of online shopping frauds registered with the National Consumer Helpline has jumped nearly six times from 977 cases in FY17 to 5,620 cases in FY20 till November 2019, taking the total count of cases since FY17 to 13,993.

Needless to say, eCommerce places are flooding with various reasons for fraud to take place. Here are some of them:

- The remote working scenario can help increase sales and distribution fraud.

- Counterfeit and damaged products can be put in distribution to meet the increased demand.

- Third-party vendors and resales and their conflict of interest.

- Tampering with inventory management.

- Cyber fraud

- Hiring unethical employees / hiring employees without doing a proper background check.

How can merchants avoid chargeback?

Chargeback Chargeback is the amount that may be debited from the merchant’s account in case of a genuine complaint from the customer, for an...

Why Is Ecommerce Fraud Prevalent?

With everything going digital and the help of AI, fraudsters are becoming intelligent, deriving new ways, becoming more sophisticated with every passing year. With advanced technologies, it is easy to steal data and buy information. Online aliases are making it hard to detect and catch the culprit. In the comparison, time and resources constraints on gathering the evidence and prosecutions are not so much.

It is a necessity to use a high-quality fraud detection and management system and integrate advanced strategies with your business to fight fraud.

Types of Ecommerce Frauds

1) Identity theft

Identity theft or identity fraud takes place when an impostor obtains and uses personally identifiable and financial information of another person. This is the form of illegal impersonating. It is the unauthorized use of personal and financial data.

This fraud not only affects customers but equally affects the merchant, as customers can place a refund request.

Customers may feel that their personal and financial data is vulnerable and can not be shared on the eCommerce websites or web-shops are less likely to checkout. This can cost a store dip in reputation.

Account takeover is a form of identity theft, in which the fraudster gains access to the user’s account and engages in fraudulent activity.

This can be done by a variety of methods, like purchasing and hacking details like passwords, security codes, implementing phishing schemes, etc.

2) Chargeback fraud

This is also known as friendly fraud. In this type of fraud, the customer keeps the goods/products purchased online from the eCommerce shop but still asks for a refund stating purchase never made or payment being made twice or item was never received.

Having a clear refund, reshipping, tracked shipping, and return policies for the e-store may help to reduce this ‘friendly’ fraud.

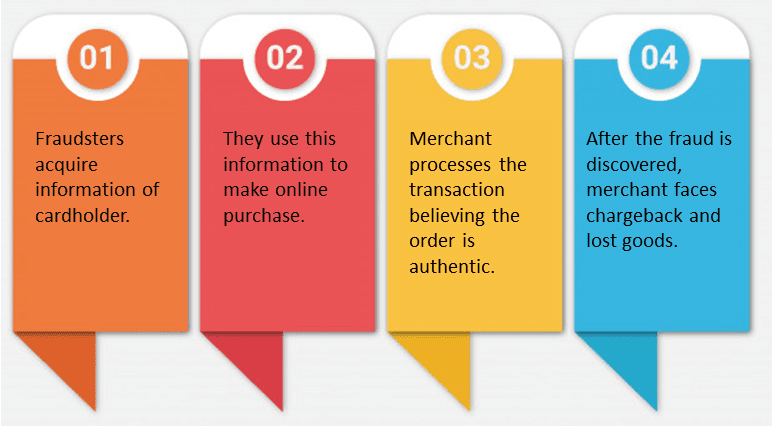

3) Clean fraud

This fraud is done with the stolen credit card from a genuine user and is used to make an online purchase. The stolen card and card holder’s information is used to commit the fraud which looks like a legitimate purchase made by verified customers.

How Credit Card Fraud Can Be Prevented with Merchant Plug-In

How Credit Card Fraud Can Be Prevented with Merchant Plug-In Lyra MPI has become even easier to keep credit card fraud at bay and provide the...

4) Phishing

In phishing personal information of a genuine user like user id, card number, password, other credit card information is collected via a fraudulent SMS or an email and used to make an online purchase illegally or without the owner’s knowledge.

In this type, the user generally gets an SMS or email requesting personal data or a false link to install the malware to obtain this personal data. The fraudster often pretends to be a trusted company or source to ask such information.

4) Triangulation fraud

In this type of fraud, the fraudster creates a fake online shop offering goods/ products at cheap prices. These webshops are used to collect credit card data from the customers who visit the site.

When the order is placed, the fraudster orders the product from the real website/merchant using the stolen credit card information and has sent that product to the customer. Fraudster gains the payment for the goods and the customer ends up paying twice. Once for the fraud store and once for the actual price to the real merchant.

How to Detect Ecommerce Fraud in Online Transactions

Fraud detection in eCommerce is becoming a prime necessity. How exactly fraud happens. Who fraudsters target to commit the fraud? What kind of things a business should look into to detect the fraud?

Here are some red flags to identify if the transaction is possibly fraudulent or not:

- First-time shoppers on an eCommerce website they have never shopped before.

- Large quantities of products

- Fast shipping

- Shipping to the unusual location

- The contradiction between shipping address and IP address

- Using multiple cards on a single IP address

- Multiple transactions in a short amount of time.

- Shipping to an incomplete address

New Ways by Which Ecommerce Fraud Is Being Performed

- AI-enabled bots generated from data breaches can be used for identity theft and account takeovers.

- Fake accounts with real information making it difficult to find the account and account holder is authentic or not.

- Frauds using the financial patter, card holder’s negligence.

How to Prevent Ecommerce Frauds

Fraud often leads to chargeback. Here is the chargeback guide . Chargeback processing includes overhead costs like operational costs, transaction fees, etc.

And if the product is sold to the fraudster there is little to no possibility that the merchant will get back that product.

This not only leads to a dip in the revenues but also losing a customer.

So, eCommerce businesses must take preventive measures and protect themselves and their customers from fraud.

Here are some measures for fraud prevention in the eCommerce business.

- Using updated and high-quality software for running online stores.

- Use improved and reliable third party payment processor.

- Using Address Verification System (AVS) and Credit code Verification (CVV).

- Making sure that all the websites representing the online store are secured with HTTPS.

- Using fraud detection and management software to detect high-risk transactions.

- Analyzing the risk factors and doing a fraud risk assessment.

- Making the online payment process compliant with rules, applicable laws, and regulations.

- Fraud awareness sessions for employees and customers

Boost Your Sales

Let Us Help You Find the Most Secure Payment Solution

Read about the latest trends, news, and fintech updates here