Payment links for easy and fast online payments

India being a strong developing country is fueling India’s business landscape to grow in multiple areas above and beyond.

With technology-driven growth and innovations the number of businesses in India is ever increasing, be it a small home-based business or a multinational one.

Customers are embracing social media and remote shopping and businesses are also falling into the comfortable routine of selling goods and services online via websites and social media and taking full advantage of it.

But during all this, merchants are continually facing one problem – How to accept payments for home delivery services or from customers who are remotely located?

Well, the answer is two words, Payment Links.

More simple than it sounds, online payment collection via payment links is becoming quite popular amongst merchants as the fastest way to collect payments.

With payment links, not only you can collect payment anytime, anywhere, but payment links also come in bulk creating options saving your time.

Whether for a fixed or variable amount, it would only take a couple of seconds to create the payment link. This link can be shared via any social media platform or any messaging application.

One of the most convenient things about payment links is, even if your business doesn’t have a website or a mobile app, you can accept online payments.

So, What are payment links?

Payment links are the URLs with which merchants request customers for online payments. It is a hassle-free payment acceptance method by sharing the URL embedded with the online transaction itself.

What is the need for a payment link?

In simple words, payment links are there to ease the payment collection. This is the simplest online payment collection method which is convenient not only for merchants but also for customers.

As aforementioned, payment links allow remote payment collection through URL and eliminate the need for a website.

The main advantage of the payment link is payments can be done from anywhere at any time and customers have the liberty to choose any payment method they prefer.

How payment link works – for customer

After customers confirm the purchase and a merchant requests online payment via a payment link, it acts as a ‘pay now’ button for the customer.

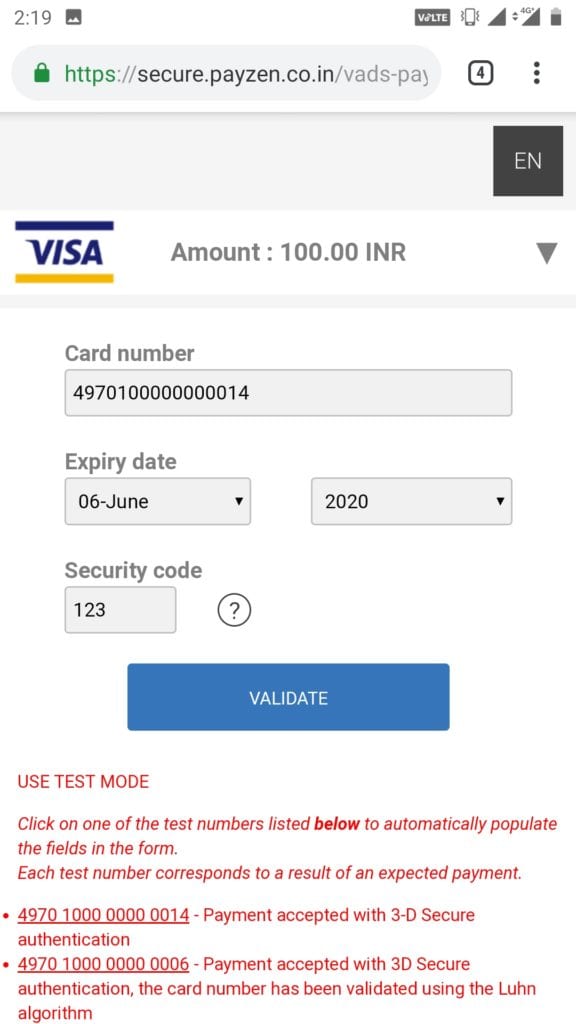

Payment links can be sent via any messaging application. After receiving and clicking on the payment link, it pulls customers through to their preferred payment processor followed by the payment methods, eg. card, mobile wallet, UPI, etc.

Customer follows the link to their preferred payment processor and the payment method to finalize the transaction.

How payment link works – for merchants

For merchants, the payment link works in three simple steps,

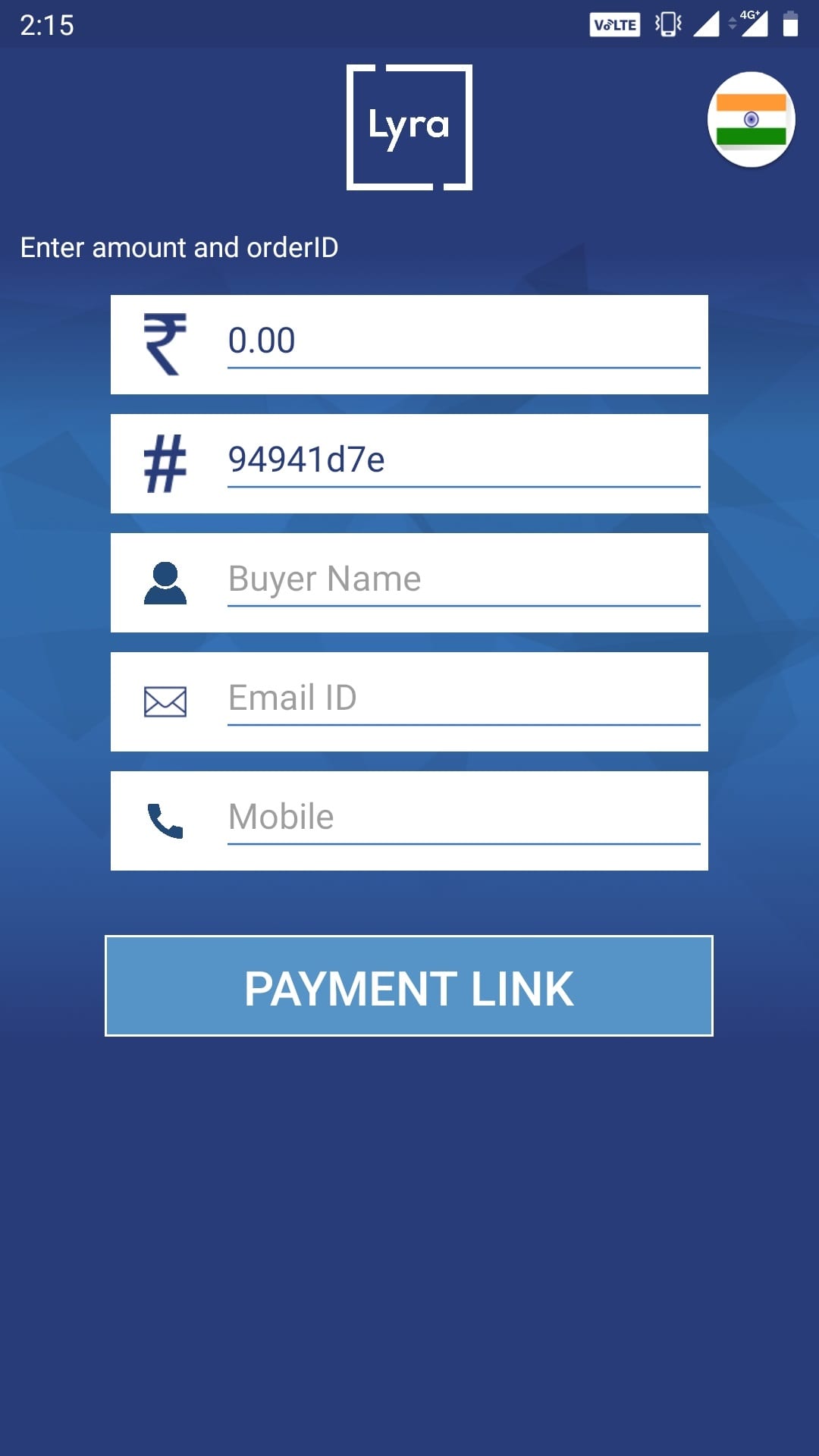

- Create the link – The first step is to create the payment link. Payment links can be created from the dashboard, APIs, or the mobile application. For example, Lyra EPOS. With Lyra EPOS mobile application merchants can create the customized payment link by entering customers’ contact numbers – to share the link and the amount.

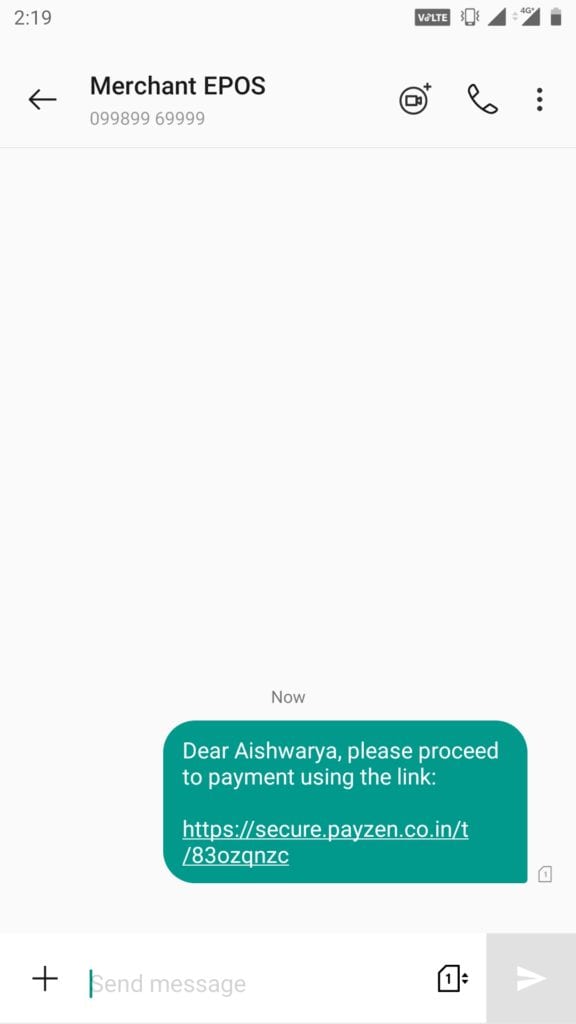

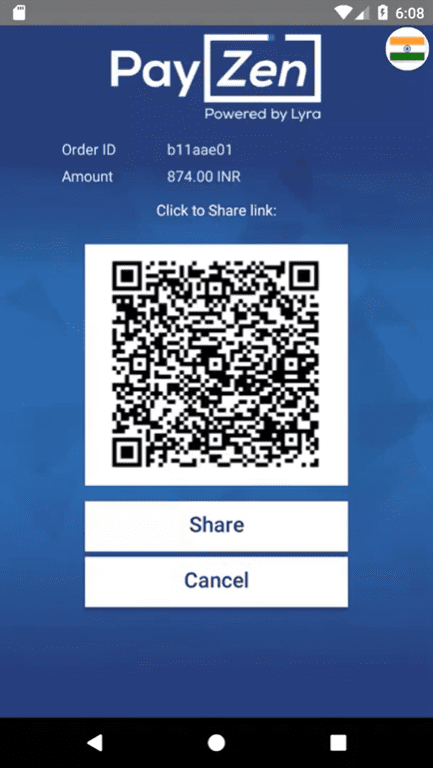

- Share the link – Once the link gets created, the merchant can share the link with customers. Lyra EPOS application allows merchants to share the link via any messaging application or a social media channel and also provides the QR code for the same transaction amount for on the spot payments.

- Collect the payment – once the link is shared with the customer and the customer clicks on it, it redirects the customer to a payment page where the customers can choose any payment method to their liking and complete the payment. After the payment is completed, the merchant gets the notification.

With Lyra EPOS mobile application, merchants can create unique payment links and share them with customers. Customers can use any payment method of their liking and complete the payment.

Extended features that Lyra EPOS offers

EPOS application replaces your bulky physical POS machine and saves the overhead cost of POS maintenance and training.

With the simplest user interface, Lyra EPOS helps merchants to create payment customized QR codes and payment links.

The shared payment link is backed with the most secured payment gateway in India, Lyra Payment Gateway, and also offers fraud and chargeback minimization.

Even if your business doesn’t have a website or a mobile application, Lyra EPOS allows quick cashless payment acceptance.

Your customers need not to download any additional application to complete the payment. There is also no need for customers to share their personal, bank, or any unnecessary details.

Lyra EPOS offers a secure channel for online payment acceptance. It is compliant with PCI DSS standards, card schemes and is 3D secures.

Lyra EPOS offers multichannel payment acceptance, seamless flow of transactions, and convenient on the spot payment collections from your mobile phone.

Lyra EPOS for your small businesses

25/08/2020Lyra EPOS for your small businesses As we are getting used to the pandemic, we are also getting used to the new lifestyle that pandemic has forced...

Read about latest trends, news and fintech updates here