Pandemic has made the payment landscape all over the world undergo quite a revolution. These radical and rapid structural changes moved payment mode from cash to non-cash.

Making different digital payment trends like contactless cards, mobile wallets, QR payments, BNPL model, neo banking, open banking, etc.

becoming popular in different countries. India also embraced the trends pretty quickly with customers getting comfortable with digital payments and the government advocating and regulating the digitalization of payments to improve the experience and security.

Today, thanks to innovations in the payment industry, payment transactions have become much more than just an exchange of money.

As people are moving on to digital and mobile payments, businesses are using the reinvented payment experience as a branding opportunity.

And at the center of this is ‘PayTech’, a subsection of fintech that focuses on payments, transactions, and technology.

PayTech or Payment Technology, a payment that involves technology includes everything from IoT to cryptocurrencies and from contactless payments to mobile wallets.

With increased competition and a ‘flexible and future-ready payment system’ becoming a need of the hour, PayTech is becoming the future of payments.

Players in the PayTech industry

- Card Networks

- Acquiring banks

- Electronic Money Institutions (EMI)

- Issuing banks

- Payment Gateways

- PSP (Payment Service Provides)

Though the PayTech industry is heavily regulated and requires payment companies to remain highly compliant, at the same time, thanks to these regulations and initiatives, PayTech is booming. And thanks to rapid digitization, it is safe to say that PayTech will become even more popular.

PayTech enables an omnichannel experience where customers can seamlessly switch between offline and online payments.

With the developments like cryptocurrency, blockchain, and ML, AI PayTech is enabling on-the-spot, secure, and low-cost payment solutions with a customized experience.

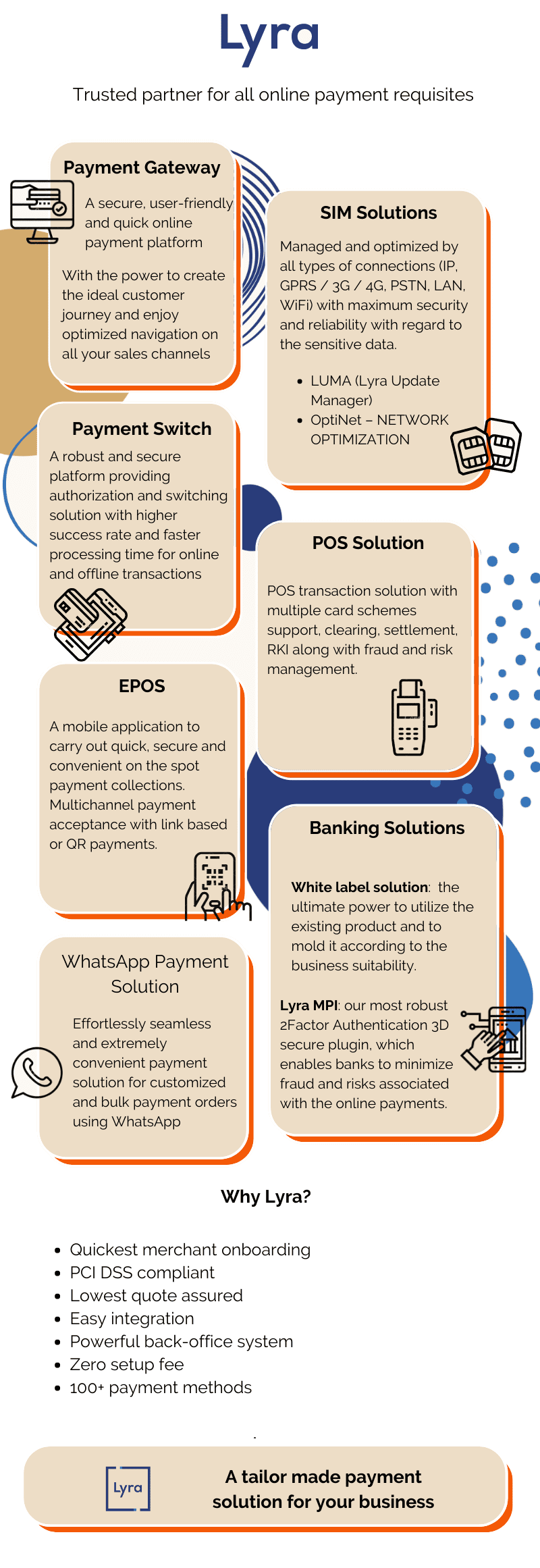

Lyra – Lyra Network India is a perfect example of a leading fintech company that offers tailor-made pay tech solutions.

Lyra is actively working in sectors like payment gateway, white label solutions, Pos solutions, banking solutions, etc. With the unique technologies to optimize transaction costs and time ensuring data security for its users, Lyra is considered India’s one of the most secure PayTech solution partners. Lyr is a robust and stand-alone payment service provider with no third-party dependency.

Lyra deems a great deal to security. All of Lyra’s solutions are 3D secured and are in compliance with the government data security protocols and PCI DSS standards.

Lyra also offers anti-fraud tools and a 24/7 helpdesk for its customers. Lyra also offers solutions catering to omnichannel needs for businesses and offers 100+ payment modes including UPI, net banking, card payments, mobile wallets, etc.

Here is a glimpse of Lyra’s services and solutions,