How can Freelancers Accept Digital Payment Online

How to accept online/digital payment if you are a freelancer

As the world is adapting to the new and improved lifestyle choices, people are also switching from their 9 to 5 jobs to a more comfortable world of freelancing and building their careers.

Freelancing is no longer considered a part-time job, nowadays, it is seen as a way to earn big while working on what you love from the comfort of your home.

Today, India is a country where the freelancer market is the largest with more than 20 million people freelancing, and the number will only grow.

Many businesses also consider hiring freelancers, considering this growth and remote and flexible working.

However, despite all these positive and empowering effects and changes, freelancers are facing various problems when it comes to running a successful ‘freelancing’.

Key challenges for a freelancer

These freelancers or unregistered businesses generally work on referrals from previous customers.

It is immensely necessary to deliver great work on time. For a freelancer, there is little to no information on how to gauge the new customer and ensure their commitment.

One of the key problems is collecting payment after the work is submitted. Getting paid by the customers on time is the most critical situation for any freelancer.

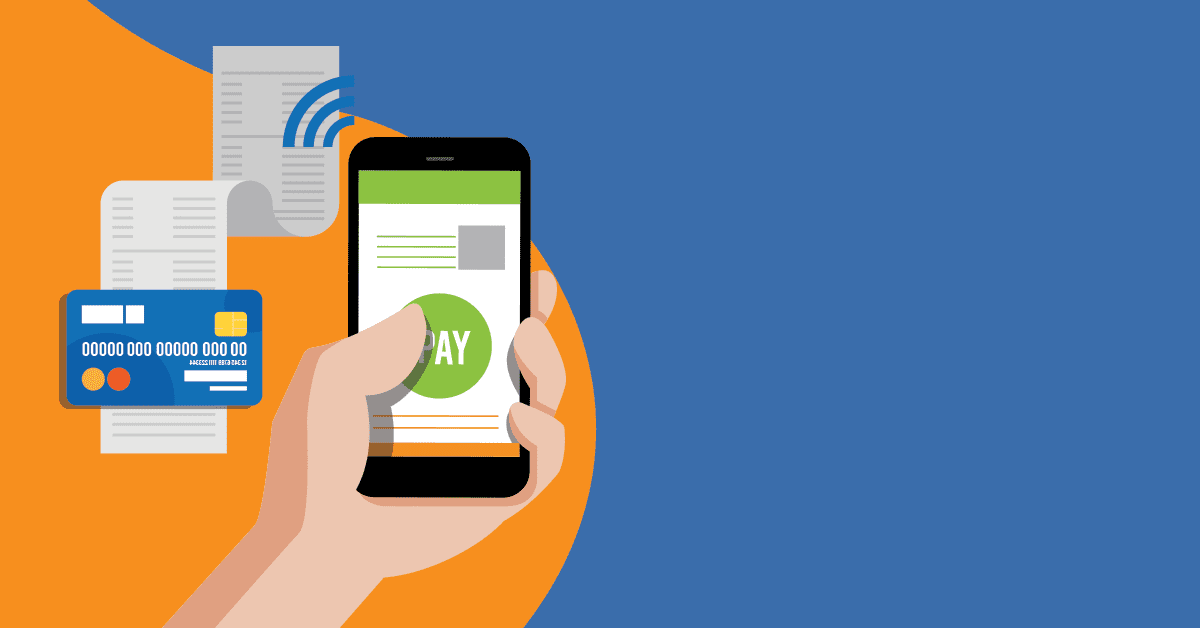

What are Payment links?

Making payments is all about convenience, security, and speed. India’s payment system evolved from the barter system to cash to cards to digital...

Late, irregular, or no payments:

Unfortunately, this is one of the consistent key problems. Freelancers often deal with such types of payments.

Depending on the amount and period of work, it is understandable to have an irregular payment cycle.

But most of the time, payments are often delayed even after the work is submitted, in some cases, freelancers face retraction on payments from clients.

So, it becomes inevitable to follow up each and every time for unpaid dues.

Showcasing the brand:

This is one of the key comparison points between freelancers and registered established businesses.

For any freelancer, it is extremely important to showcase the product or services he/she is offering.

Many freelancers fail to brand their product/service and face an unnecessary outage of work.

While most of them have been using social media, it is important to be able to “use” it for the advantage of business, boosting their presence and in turn their sale.

A seamless, easy to use payment acceptance solution:

The most common way to accept payments is by cash, cheques, or by bank transfers. This increases the headache of raising invoices, managing them, and following up.

But considering the remote location of working and wasting a significant amount of their time managing all the transactions, many freelancers are diverting their payment acceptance to digital means.

In the market, there are lots of applications that enable accepting digital payment.

Freelancers spend an excessive amount of time following up and solving these problems, which can definitely be used for working.

With all these problems, freelancers look for the easiest implemented solutions to solve their problems.

So, what is the solution?

Unable to collect digital payment due to a lack of proper knowledge about the digital payment solution may lead to late or no payments, which can create an unpredictable financial crunch.

Now, Freelancers Can Collect digital Payments Without Having a Website.

Freelancers Payment Methods:

1) Collect via sharing the payment link

Making the payment process seamless for your customers is one of the key points of having a smooth checkout process.

Both merchants and customers prefer to use a single application for online payment.

With the Lyra EPOS app, customers don’t have to download any special application for making payments. It’s a payment link-sharing application.

Merchants can share a link or a QR code and customers just have to click on the payment link to proceed with payment.

All about E-POS and its Top five Benefits for your Business

E-POS as one of the Digital Payments' Methods E-POS is one of the digital payments methods that a business can opt for, especially in the case of...

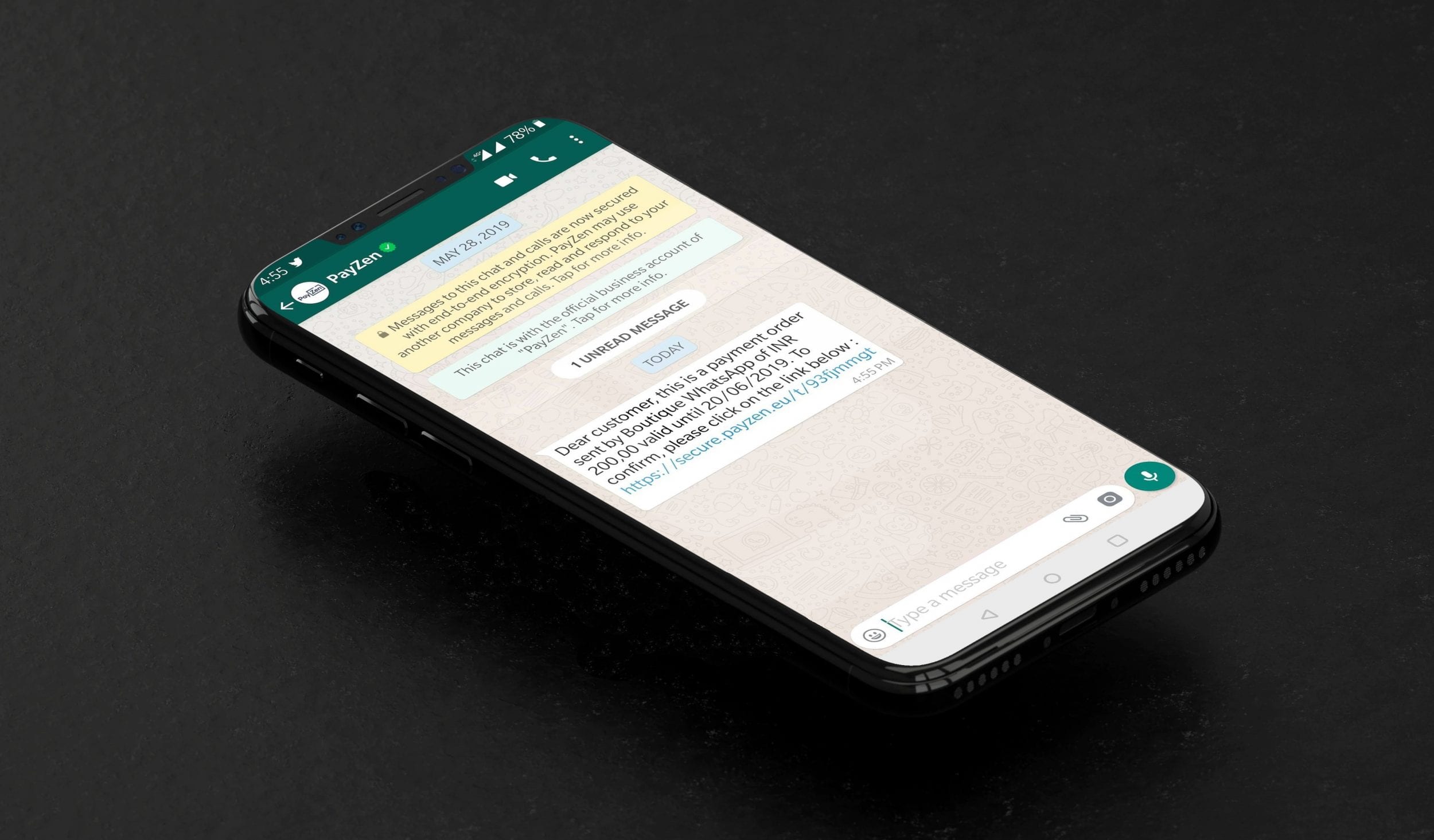

2) Use WhatsApp to collect payments

As said earlier, branding and showcasing your product is the key to the door to success. And what better platform is there than WhatsApp?

WhatsApp makes communication more fluid compared to any other application, with WhatsApp, you can send broadcast messages, share promotional content, make client-oriented groups, and many more.

Being a purely messaging application, WhatsApp becomes an ideal solution for creating your product showcase, showcasing it, accepting orders, keeping track, and finally accepting payments.

Learn more about Lyra Whatsapp Payment Solution

What is Whatsapp Payments & its top 9 features

For the first time in India Lyra has introduced an extremely convenient and on-the-spot online payment collection solution – Lyra WhatsApp Payment...

Why Lyra?

Instant onboarding: You can get onboarded within a few minutes and can start accepting digital payments. With no setup fee and zero maintenance cost, you can save a lot!

Multiple payment options available: With Lyra, customers can pay with whichever payment option they are comfortable with. They get options like UPI, credit/debit cards, net banking, etc.

International payments: For your international projects, you will get the advantage of global payments, multi-currency management, and support in each country.

Chargebacks and fraud management: Lyra’s anti-fraud tools and chargeback management will make sure your transactions will happen smoothly.

Secured transactions: All of Lyra’s digital payment solutions are in compliance with VISA and MasterCard and are PCI-DSS 3.2.1 secured.

Your, as well as your customer’s data and transactions, will be secured by an SSL certificate and 2FA.

Accepting digital payments is really a boon for freelancers. It is a secure and hassle-free solution to accept payments, save time, and boost the business.