All about the Benefits of Digital Payments

India has always been extremely comfortable with the traditional method of making payments, which is “via cash”.

Nevertheless, it is imperative to understand how digitization with regard to making payments has helped the country in numerous ways.

It is a known fact that India has taken a sharp turn towards “becoming a cashless economy” after demonetization and it has nudged the country even more towards settling as a developed economy.

Digital India movement/initiative by the government has led to a humongous shift in the way Indians deal with making payments for purchases.

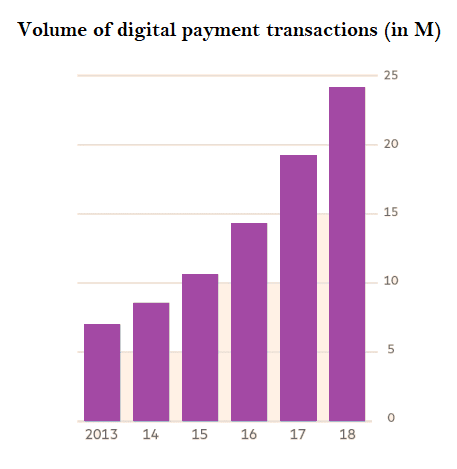

Based on data from RBI – here is growth in Digital Payments in India over the last 6 years:

What are Payment links?

Making payments is all about convenience, security, and speed. India’s payment system evolved from the barter system to cash to cards to digital...

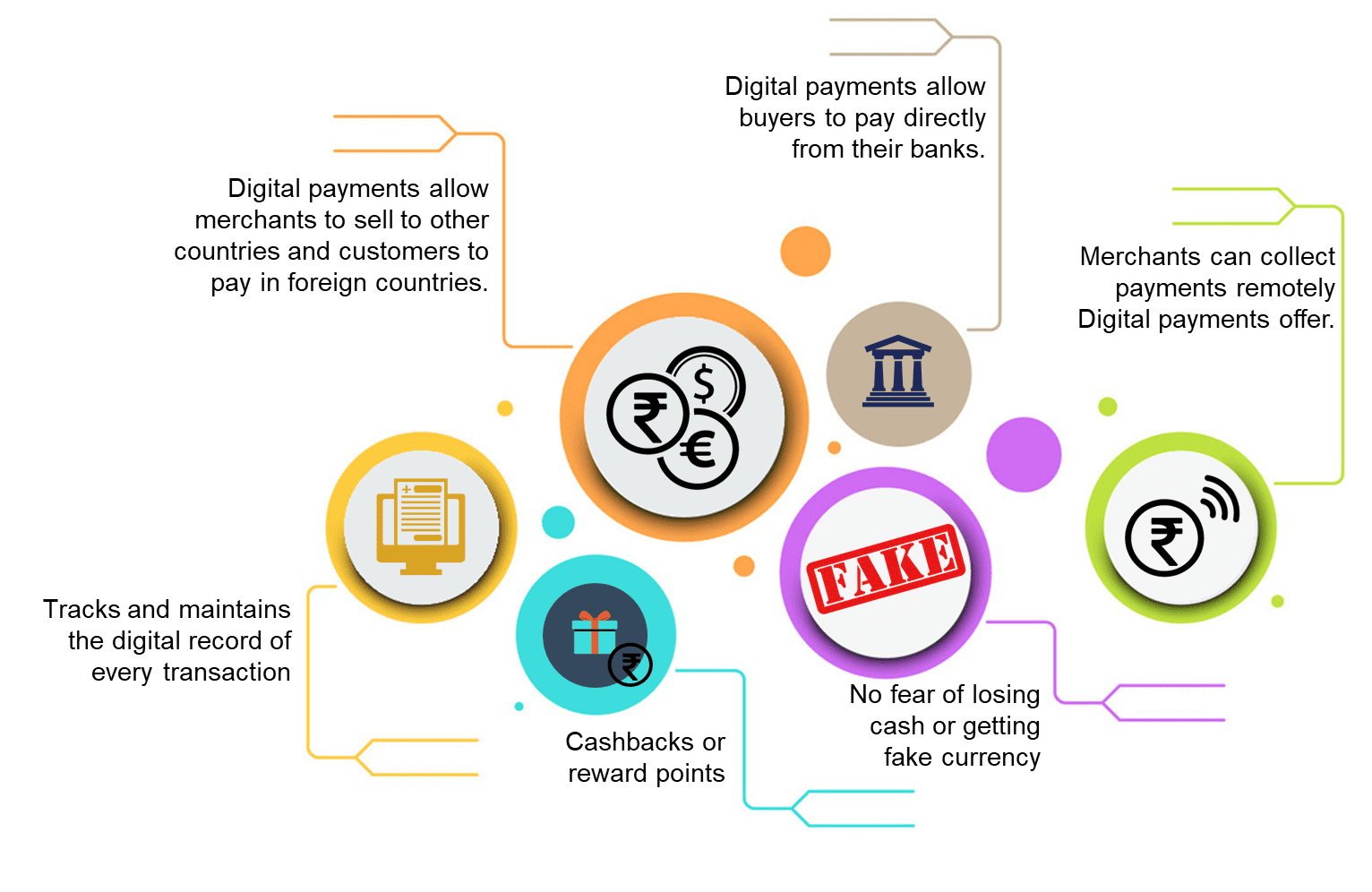

Benefits of digital payments

- Digital payments allow buyers to pay directly from their banks.

- Digital payments allow merchants to sell to other countries and customers to pay in foreign countries.

- Tracks and maintains the digital record of every transaction

- No fear of losing cash or getting fake currency

- Merchants can collect payments remotely

- Digital payments offer cashbacks or reward points

As online businesses, as well as purchases, have become a current trend in India, going digital offers the following benefits to the users:

Ease of carrying out transactions

This is one of the major benefits of digital payments.

For those who carry out transactions on a daily basis for buying some, or the other product or service, going digital is quite beneficial.

It aids the user by giving an option that is safer, quick, and convenient during the traveling time.

It helps the user be free of carrying wads of cash, plastic cards (debit, credit, etc.) and even helps in letting go of queues for ATM withdrawals.

Moreover, online payments can be carried out without any hassle during the times of emergency as it does not require one to be physically present anywhere for the money to be paid.

E. g. Digital wallets: Digital wallets provide a quick, seamless and convenient way for merchants as well as customers

This also helps save the immense time of the user so that the user is able to utilize time for other important tasks/aspects.

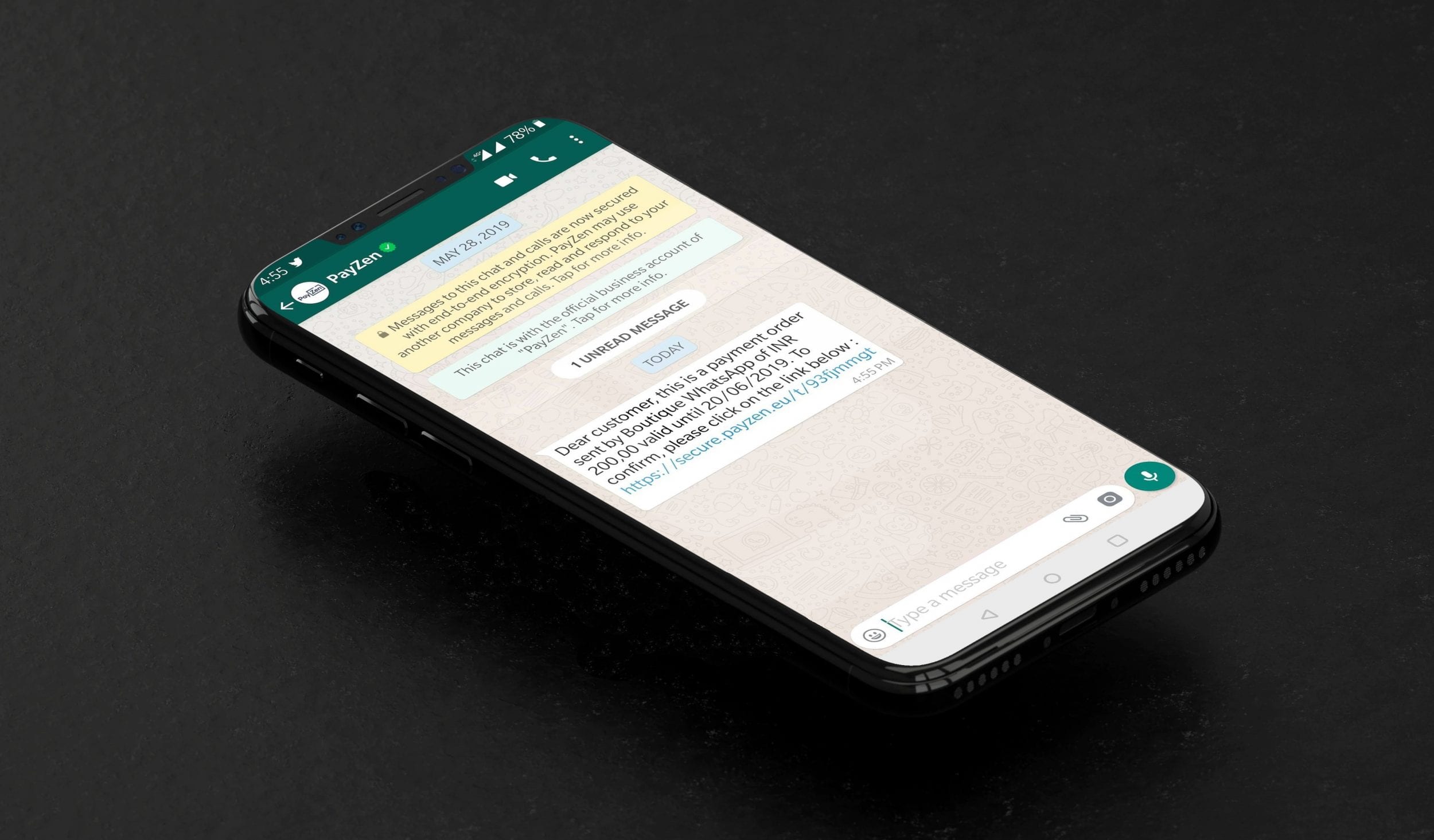

What is Whatsapp Payments & its top 9 features

For the first time in India Lyra has introduced an extremely convenient and on-the-spot online payment collection solution – Lyra WhatsApp Payment...

Provision of Discounts

Going digital can benefit the users in terms of discounts provided to them for various occasions as well as purchases.

For example, for encouraging people to use the digital method of making transactions, the government announced a waiver of service tax on debit and credit card transactions up to Rs 2,000.

Such incentives and measures by the government help people be more digital-friendly, and thus, helps the government keep tabs on tax evasion.

Moreover, the customer avails the benefits of discounts online every now & then and gets a fair price for the product/service needed.

Better way to Observe Spending

With digital payments being convenient not only in other aspects but also in terms of keeping a record of the payments done so far, it is but easy to be accountable.

When the payments are made via digital channel, it is easier to file income tax returns and also is easier to explain the spends in case of scrutiny.

Helps in Better Investments

As making transactions digitally helps individuals observe their spending, psychologically speaking, it becomes obligatory to ward off some of the expenditures.

This, in turn, helps increase savings, which can lead to an increase in investments. Hence, with online payments, there are better chances of people being able to save more for investments.

More investments lead to more earnings and thus, it proves to be quite beneficial for the users.

Option to deactivate in case of theft or any accident

Payments have evolved from the barter system to cash to card payments to digital payments. According to Statista, in India, the total transaction value of digital payments in 2019 amounts to US$64,787 million.

Digital payments have the upper hand over making cash transactions since a digital payment platform can be blocked immediately in case of theft.

But it is not the same with cash payments, since the cash once gone, has minimal to zero possibility of coming back to you.

Moreover, carrying bundles of cash with oneself while traveling is never recommended and neither is easy.

Small benefits

Many benefits of digital payments come in small packets. Whether you carry a bunch of coins with you or not, you have to never worry about keeping change-ready while making payments via the digital method.

Making transactions digitally helps you pay exactly the amount that is required to be paid, and hence, makes your life much simpler this way.

While traveling, loss of cash can cause an inconvenience, using digital payment solutions seems a safer and convenient solution.

There is no need to wait in the long lines to make payments, with digital payments, payments can be done much faster and from anywhere you want.

How can small businesses receive Digital payments

Online payments and small business How can small businesses receive payments online? The question remains popular despite the launching/...

Future of Digital Payments

Payments have evolved from the barter system to cash to card payments to digital payments.

According to Statista, in India, the total transaction value of digital payments in 2019 amounts to US$64,787 million.

Many companies are developing the applications and methods more seamless for both customers as well as merchants.

Now there is no need for customers to give their card information for digital payment (epos link), as for merchants, they can accept bulk payments, split payments with just a click(WhatsApp link).

And everything is possible because of using means of digital payments.

Many Payment services provide as well as financial institutions are opting for secure ways to make online payments secure for both merchants and customers.