The era of Digital Money

In simple words, Digital Money, Online payments, Digital Transactions, or Digital Payments, all mean the same, i.e., making and receiving payments over the internet.

When a customer navigates through an online portal or website for buying goods or services, there are several options for making payments. Such options can be all or some of these:

- Credit/Debit card

- Net banking

- UPI

- E-Wallets

- Payment via e-mail and SMS

- EMI Payment Option

- Split Payments

- 1-Click-Check-out

- Multi-card payments

With such a variety of options, it becomes simpler for the customer to choose its payment mode without any hassle.

The ease, convenience, and safety that online payments offer to both the customers and businesses make it the most preferred option for making transactions in today’s time.

Financial Technology (Fintech Domain)

The fintech domain is the service-providing industry that collaborates financial services and technology to provide the masses with the best innovation in the payments industry.

It provides financial services to POS terminals, e-commerce portals as well as APIs successfully. Besides, there can be an API (application) of the payment service provider (Fintech company).

With the API, payments can be made via the application at a brick-and-mortar setup.

Although Fintech is a new domain, it is advancing at a rapid rate and aims to go beyond the traditional financial methods prevalent for a long.

The major role of Fintech is to introduce and offer such advanced payment services that help maintain the security of transactions for the masses at large. Hence, as technology is advancing, financial services are also advancing with the same.

It is visible in a variety of new or updated ways of making payments online, which are even more convenient. However, with such advancements, new fraudulent activities also crop up at an extremely fast pace.

In order to combat these, there is a need for the service provider to intervene. Fintech introduces new or updated financial services on new (or existing) platforms with exceptional security features.

This allows the masses to continue enjoying the ease and convenience that digital payments bring with them.

Advancements in Digital Money over the years

When POS terminals made their way into the financial ecosystem some years ago, there were challenges that simultaneously struck the nation in terms of their full acceptance.

Although, with the passage of time, dynamism in the digital money industry and an increase in the awareness about the benefits of making transactions online led to more people adapting to the same.

A rapid elevation over the years lately has added to the security and advanced features for the users.

Ever since payment gateways and APIs (Applications) came into existence, they have proven to be a boon for the economy since they need no physical presence of cards.

These mediums of receiving as well as making payments are extremely convenient and time-saving options for an online business.

Undoubtedly, the journey of digital money is a successful one, with the majority of the people in the country shifting in its favor.

This being said, it is imperative to mention that Fintech is a young industry, which has managed to rise tremendously well in a short span of time.

Some years ago, people in India hesitated to indulge in online payments as they found the traditional methods, i.e. “Cash” more trustworthy for their daily transactions.

Despite the disadvantages of carrying wads of cash, like vulnerability to theft and storing hassle, people only gradually shifted to online payments.

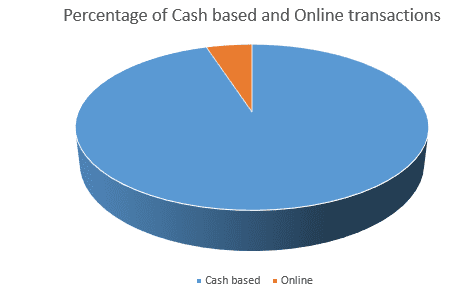

It was mainly because people were not sure about the operation and security of digital payment methods. This led to 95% of people transacting in cash, and unorganized sector entities as well as workers preferring cash-based transactions majorly.

However, when demonetization took place in 2016, it pushed the economy further toward adopting digital payments and hence, immense development.

Immediately afterward, the government began providing people with several incentives/concessions/benefits for opting to use online methods of making payments.

In today’s time, India is the 13th largest non-cash payment market in the world and is perceived as having the potential to grow furthermore.

This supports the fact that lately, many more merchants have started installing POS systems to accept card payments.

Even though the challenges like weak internet connectivity and costly and time-consuming purchases of POS terminals exist, digital money in India has picked pace.

Nevertheless, RBI is constantly making sure that the digital payments industry grows successfully in the country. This is visible in several time-to-time measures RBI has been taking to make sure that people adapt to digital payments.

Very recently, the ombudsman scheme has made it even simpler for customers to raise an issue with regard to incorrect debiting of money from their bank accounts.

It is a rescue for those end users that are not able to get their issues resolved by their respective service providers.

Be it a failure to effect online payment or fund transfer, a failure to refund the money in case of a failed transaction, or any similar payment-related grievance, now there is an Ombudsman to take things into its control and resolve it all.

Even the complaints about Unified Payments Interface (UPI), Bharat Bill Payment System (BBPS), Bharat QR code and UPI QR Code are to be also looked into by Ombudsman for Digital transactions.

With the advancement in technology, Near – Field Communication (NFC) is yet another beneficial service, which has simplified the use of digital payments.

NFC is that set of communication protocols that allows two devices to establish communication with each other when brought together within the range of 4 cm.

Another wondrous innovation is the facility of instant bank-to-bank transfer with a single API.

Way to go for Digital Payments

In the recent move, RBI has laid 12 objectives in favor of making India a “Cash-lite” economy in the next three years.

These objectives include everything to better the digital payments and make them be more accessible. Various challenges like internet availability, awareness about digital payments, and others are looked into following which, these objectives are being worked upon.

By executing these, it is expected that many more people will be inclined toward and will benefit from digital payments.

Seeing the world grow with innovative, useful, and convenient technology/furtherance is what Digital Payments Sector is geared up to adopt.

As far as the future possibilities are concerned, the next generation is going to witness myriads of improvements in the Digital sector.

What can be assumed and expected from the payments sector is more secure digital transactions in the coming future.

The same is possible with innovations like iris recognition or a chip tied to the wrist of the cardholder with which maximum security is anticipated for the masses.

Since there can be a tremendous amount of possibilities, there are no boundaries when it comes to digital payments.

As the young generation will keep taking the lead to transform digital space, endless changes are expected for the benefit of society as a whole.

There are some anticipations with regard to the evolvement of payment gateways, which are going to make the same more efficient for society at large:

- Automated payments to suppliers at a pre-decided interval as well as receiving of automated payments from distributors.

- Linking of payment gateway with the individual’s credit card to automate payments of services like rented cab services.

- Payment gateways are equipped with technology to validate payments with thumb/ finger impressions. This removes the need to enter CVVs, credit limits, or even passwords.

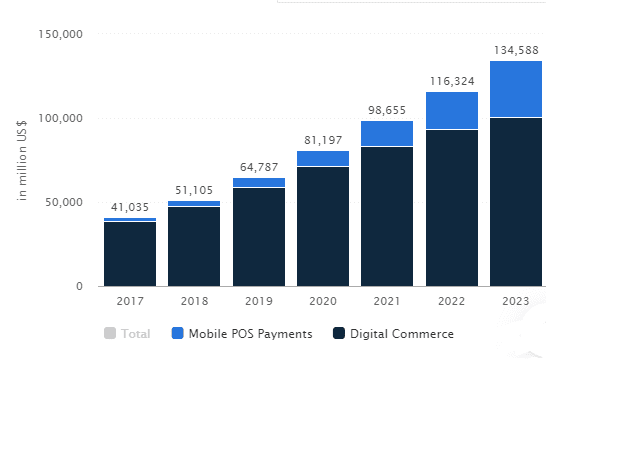

Source: Statista.com

According to the graph above, it is quite clear that, in India, digital payments are on the rise ever since the digital wave started in 2017.

Over the years, if the trend goes in the same manner, online payments are going to be more and more adopted in the coming time.

To enjoy the benefits that payment gateways can bring in the near future, the digital payments industry will need to pick pace with regard to advancements.

This is only possible with quick innovations and implementations of the same, which are already happening in full swing.

Since advancing technology is continuously giving opportunities to digital money to be further innovative with its services, the future of digital money seems exceptionally astounding.