Benefits Payment Gateway and an E-commerce platform

The e-commerce industry in India is growing rapidly. With the goal of providing customers a convenient and secure platform, seamless transactions and delivery to their doorstep, e-commerce platform requires an efficient payment gateway which will increase customer loyalty and in turn sales and profit.

POS being the popular mode of payment collection, the main difference from the POS terminal is: in case of a payment gateway, the shopper may be sitting in a different city, state or a country altogether. Because of the distance and anonymity of the shopper, a payment gateway requires special encryption and verification technology. The E-commerce platform has it’s own shopping platform space online, these platforms are convenient for shoppers with several benefits attached, such as:

But for customers to have a seamless shopping experience, having an easy to navigate APIs (applications) are not enough. An e-commerce platform requires an efficient payment gateway to add on to the safety of payments, leading to customer loyalty and increased profits.

Benefits of payment gateway

Getting a digital platform to accept the payments online can ultimately improve the overall performance of your business. Here are the benefits of implementing a payment gateway:

- Easy Checkout: The swift and seamless checkout experience is a must from a customer’s point of view. Payment gateway enables these features and makes online shopping as easy as possible.

- Impulse purchase: It is observed that more than 40% of customers cancel their purchase if the checkout/payment method is tedious or complex. But, according to a study, it is observed that impulse purchase is responsible for 40% of all online purchases, so being provided with an easy payment option will undoubtedly make an increase in sales.

- Payment gateways also

- Integrates with shopping cart

- Provides faster payment processing

- Accepts multiple payment options

- Provides chargeback prevention

- Provides fraud management

- Also, Provides recurring billing

- Security: Payment Gateways are often compliant with security standards like PCI DSS, etc. providing secure transactions

How does Payment Gateway works?

Here are the basic working steps for a typical payment gateway :

- A customer initiates the payment transaction by clicking on ‘buy now’ or its equivalent button on the website.

- E-commerce platform takes the customer to a payment gateway where the customer will enter relevant card details.

- Payment gateway redirects the customer to a secure page for authorizing the transaction.

- Once the transaction is approved by the payment gateway, banks make the checks on the customer’s account to decide whether the transaction is a success or not.

- Payment gateway sends the message (successful transaction or error in the transaction) to the customer.

- If the transaction is successful, the bank settles the payment with the payment gateway.

- The payment gateway then settles the payment with the merchant, notifying the customer that the transaction is successful and the payment process is complete.

What is Payment Gateway and How does it Work

What is Payment Gateway? A payment gateway is an online payments service that, when integrated with the e-commerce platform, is devised as the...

Payment Gateway as an important factor for Security of Payments

Since a payment gateway is such a crucial part of an e-commerce platform, it is imperative to understand it from the security aspect. Security, being the top-most benefit of a payment gateway, aids in lessening the intensity and frequency of credit card fraud within the e-commerce platform.

A payment gateway, as mentioned earlier, authenticates the cardholder/shopper so as to make a safe flow of payment from his/her account to the merchant/e-commerce platform’s account. This entire flow of payment is secured with the help of a payment gateway.

A payment gateway maintains security by following a protocol for the same and thus, data of the customer is encrypted in a safe manner.

There are some definite reasons, which make a payment gateway apt for the e-commerce platform:

- Integrating a payment gateway does not require much hassle and can be set up easily by the merchant/e-commerce business that already has a website/application for the business

- It requires slight maintenance, and thus, is extremely cost-effective.

- Because of the popularity of a payment gateway, majority of the people are familiar and comfortable with its concepts. This makes it easier for the online business since there is no requirement of knowledge for the same.

- A payment gateway helps in quick checkout with the customizable checkout page. A merchant thus can customize the checkout page in accordance with the demands.

How to choose a payment gateway provider

Choosing a payment gateway for your business can be a really crucial task. The payment gateway needs to be reliable and should meet your business needs now and in the future. Many factors come into play while choosing a suitable payment gateway.

What is the role of a payment gateway and what is its success rate in India?

What is the role of a payment gateway and what is its success rate in India? A payment gateway for an online business is extremely imperative...

Moreover, it is Simple to get a Payment Gateway – Hosted Page

After understanding how payment gateway integration is beneficial for an online business, it is imperative to note that it is also simple to get a payment gateway (Hosted page) and thus, all the benefits.

A Hosted Page redirects the customer from an e-commerce platform/portal/application to the payment gateway where the customer selects the payment option and fills in the card details. In this case, designing the page or validations is not required.

This way, the card details remain safe with the payment gateway, which makes the transactions highly secured. Besides, a PCI-DSS compliant payment gateway adds to the security of transactions by customers. It minimizes fraud and chargeback as a result.

The benefits of using online payment gateways for customers are many like fast payment, smooth flow of transaction, flexibility with one-click solution, secure option and an overall better experience.

It supports various payment methods such as Master/Visa/Maestro/Amex. The payment disbursement process happens in approximately 3-4 days.

Firstly, for setting up a payment gateway, an online business owner should be sure of the factors mentioned below:

- Needs to be a hosted gateway

- Should provide easy integration with the website

- A knowledge of that Payment Gateway’s fee for better decision making

Ten Payment Gateway Terms Entrepreneurs Must Know

Ten Payment Gateway Terms Entrepreneurs Must Know Ever since demonetization struck the economy, digital payments have become the most preferred...

Two ways of setting up payment gateway

A payment gateway is a platform that authorizes payments for e-businesses and online retailers. In general, there are two definite ways of setting up a payment gateway, and that happens by:

- Direct integration through the Application programming interface (API) module by connecting his Bank account with the Payment Gateway.

- Integration of the Payment Gateway firstly on Test Mode & then on Live Mode user acceptance test.

How to Test your Payment Gateway Integration

Importance and Intricacies of Testing the integration of Payment Gateway Considering the importance of a payment gateway for any e-commerce...

Hence, an increase in the demand for Payment Gateway in India

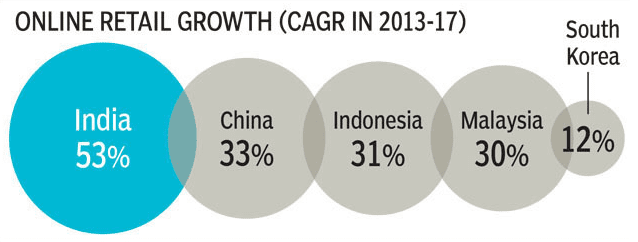

Pertaining to the timesaving, cost-effective and discount-driven e-commerce marketplaces, India has witnessed a steep rise in the demand of the same.

Online businesses, with their easy-to-use APIs (applications), have gained traction over a period. All the more, an advancement in delivery infrastructure along with smartphone penetration as well as data usage is all a plus.

But the fact remains that an e-commerce platform is incomplete without an efficient and reliable payment gateway facility. Hence, the rise in e-commerce marketplaces has led to a rise in payment gateway integration by online businesses.

The picture makes it clear that India is adopting an e-commerce platform more rapidly than any other country.

This is a vivid representation of the growing needs of payment gateway services since an e-commerce platform and payment gateway go hand-in-hand.

What Lyra Payment Gateway offers you?

Lyras Payment Gateway offers a secure, user-friendly and seamless platform for collecting online payments in real-time. It is compliant with PCI DSS 3.2.1 standards and provides fraud and chargeback management. It provides 100+ payment methods and different payment options like EMI, split payments, etc. Merchants can view and manage payments with a powerful back-office system.