Contribution to Digital Villages – Advancing Bharat

The digital sector is known to evolve with the advancing technology to get better with time and make it much easier for the masses to carry out tasks on a daily basis.

This also makes the digital payments sector need to advance with time for helping people carry out transactions faster than ever before.

The core of India is its Rural sector with 83.3 crore Indians living in the rural areas.

Digital payments have provided a boost to 37.7 crores for the Indians residing in urban areas already with the quick, convenient, and safe services.

Alongside, the emphasis has also been put on the importance of the rural sector needing to find maximum incentives for the advancements.

Lyra Network, with its payment gateway services, has also ensured from time to time to contribute to strengthening the financial aspect of rural areas.

After all, rural areas comprise some of the main sectors of our economy.

Why Digital Villages Initiative? And how has Government planned it?

According to a report in Economic Times, “The number of Internet users stood at 481 million in December 2017, an increase of 11.34% over December 2016 said the report titled, “Internet in India 2017.”

Urban India with an estimated population of 455 million already has 295 million using the internet.

Rural India, with an estimated population of 918 million, has only 186 million internet users leaving out potential 732 million users in rural India.

Because rural areas lagging behind, Government has taken the initiative to make one lakh villages Digital villages over the period of the next five years with the Common Service Centres (CSCs).

It is a public-private initiative aimed at offering excellent digital services to the villagers.

According to the Ministry of electronics and information technology, the Digital Villages initiative will initially cost over Rs420 crore ($62 million) and, along with basic internet access, will provide avenues for interactive telemedicine and educational sessions.

“The project is a public-private partnership and will be driven through the common service centers (CSCs)“.

Contribution of Lyra

Lyra’s contribution to Digital Villages, considering the e-payments domain, has been quite expansive. LYRA’s unique last-mile connectivity solution is being used by many BCs (business correspondents) to provide banking services using mobile handheld devices in the villages or rural sector at a pan-India level. A total of 10 million connections are being processed per day.

Lyra’s last-mile connectivity in Rural India has enabled the NAC-GPRS solution.

With this solution, Lyra is solving the problem of interrupted transactions in rural India because of network problems in remote areas.

This solution has helped banks conduct transactions in such areas successfully.

Conclusively, this has led to the financial inclusion of the remote sector of the country as well, and the residents have actively become a part of the formal financial system.

NAC (Network Access control) is a server that provided seamless data to the bank. NAC consists of many channels which enable communication between a payment gateway and a bank.

NAC, being a highly secure and powerful server, is able to communicate and send information of the cardholder to the merchants’ banks without any glitches.

Lyra is a payment processor for transactions between merchant POS to the client host. Lyra Network owns an exclusive EFT/POS solution using a single architecture called Lyra

NAC. In short, EFT/POS transaction gateway is called Lyra NAC.

This is able to receive and transfer any transaction flow securely from any kind of POS terminal and connects it to any type of network (PSTN/GPRS/ADSL) with any existing transaction protocol.

The exclusive EFT/POS transaction gateway is connected to the free Lyra Network e-portal and offers real-time transaction status from EFT/POS terminals in retail stores to the client hosts.

What all Lyra’s GPRS SIM solution provides:

- Subscription packages to manage costs

- Free web portal to manage SIM cards

- Dedicated LSS software for EFT servers

- High-speed truncation process

- Real-time transaction tracking system

- Quick setup of POS terminals via web-portal

What all Lyra’s IP solution provides:

- Dual Authentication platform

- PCI DSS compliant

- Robust SSL/TLS 1.2 encrypted communication channel

- Full autonomy of authentication platforms

- Quick installation

- Real-time online transaction and status monitoring

- In addition to standardized TLE encryption

- Real-time status monitoring of network connectivity

Besides, Lyra is working on the Department of Posts Rural – ICT project where the Branch postman is deployed with a mobile handheld device.

This postman delivers on-the-go services at the village level.

As there is a network connectivity problem in the remote locations, there is a provision of micro ATMs consisting of features that make withdrawals easier, quicker, and convenient for the residents.

Micro ATMs are handheld devices, which have most of the capabilities of a regular ATM, except that these are manned units, by a merchant, cashier, or field staff.

In remote locations, since the infrastructure needs to be ramped up, the availability of networks is not enough of help.

Thus, wherever the network availability is feasible, Lyra is providing the rural areas with the secured technology for successful payment transactions.

Lyra’s last-mile connectivity solution enables the handheld devices to be connected according to real-time.

This solution is successfully working in the rural areas and is helping the government to achieve the goal of making “each village a digital village”.

Lyra is ensuring the best services constantly in the following manner:

- With access to available broadband, numerous POS devices with internet connectivity are getting added to the economy. It has helped retailers access wireless POS machines with Lyra’s advanced services. With wireless POS machines, these retailers in remote areas are able to stay updated with timely advancements and positively access the same.

- Lyra is working constantly to enhance the security of transactions as, with advancements in technology, digital payments also become prone to fraudulent activities. For the same reason, Lyra is also using the dual authentication solution for keeping sensitive information protected.

- Lyra’s unique POS is also providing secure channel encryption between POS and banks with NAC connectivity. This channel is secure, quick, and updated.

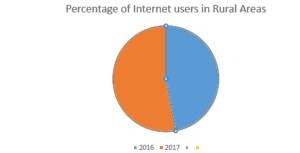

According to a report, rural Internet penetration had grown from 18% in December 2016 to 20.26% in December 2017.

This implies that Bharat is advancing every day gradually and is on the way to becoming Digital Bharat as a whole nation.

The pie chart above shows a positive shift in the percentage of internet users in rural areas in just one year.

With the steps and measures being taken to make each village a digital village, India is expected to grow manifold in the near future with access to the latest technology from time to time.