Effects of Lock down on Digital Payments

As of 12th May India is in its Lockdown4.0 stage. We are still trying to adjust our daily routine despite being confined to our homes.

During the lockdown, only essential services have been kept open.

Though some areas(green and orange zones) are now trying to reassemble themselves by opening up more stores, the risk still remains.

The virus can be spread from person to person, making currency notes potential carriers.

While in some sectors there is quite a relaxation for stores, physical access is becoming potentially risky and as a result, people are still refraining from going out to buy things and digital solutions are proving themselves convenient.

Social distancing, though good for preventing COVID 19 still has affected many of us in different ways and businesses and industries all over the world. And, fintech is no exception!

How to collect payments in your Retail Business

Retail Business Payment Collection Thanks to the digital India initiative and demonetization, digital payments are witnessing thriving growth....

COVID 19 outbreak, one of the biggest threats, has forced us into nationwide lockdown, shutting down transport, maintaining social distance, shutting down businesses from small shops to big industries, closing down manufacturing units, and sales, and cutting off the movement of the entire population.

With side effects like this, it’s anyone’s guess that the economy and financial state will take a severe hit by COVID 19.

As per reports, digital payments have fallen after taking a sharp rise.

Reasons being effects of COVID on industries that can be considered big players in digital payments like aviation, transport, tourism, hotels, entertainment, eCommerce, etc.

Whatsapp payment for Businesses and freelancers

Whatsapp payment for Businesses and freelancers A guide for freelancers and small businesses to use WhatsApp payment solution for online payment...

Due to this unfortunate pandemic, many retailers, and industries’ small shops are forced to close down.

Now that India is on the path of recovery, many stores have once again opened up.

But as the fear of viruses keeps building up, people are preferring being online and virtual instead of physical.

As a result, cash, a considerable carrier for the virus, is being replaced by digital payments.

As customers are more inclined towards online shopping for groceries, online pharmacies, online education, OTTs, online payment of utility bills, etc, these sectors are becoming game-changers for the digital payment industry.

Here are some stats,

According to a report, sectors like utility bill payments, IT, online media, and entertainment have grown by a significant amount.

Mobile payments and mobile wallets have shown remarkable growth.

Tier 2 and 3 cities are adopting digital payment systems rapidly and it is expected to rise gradually

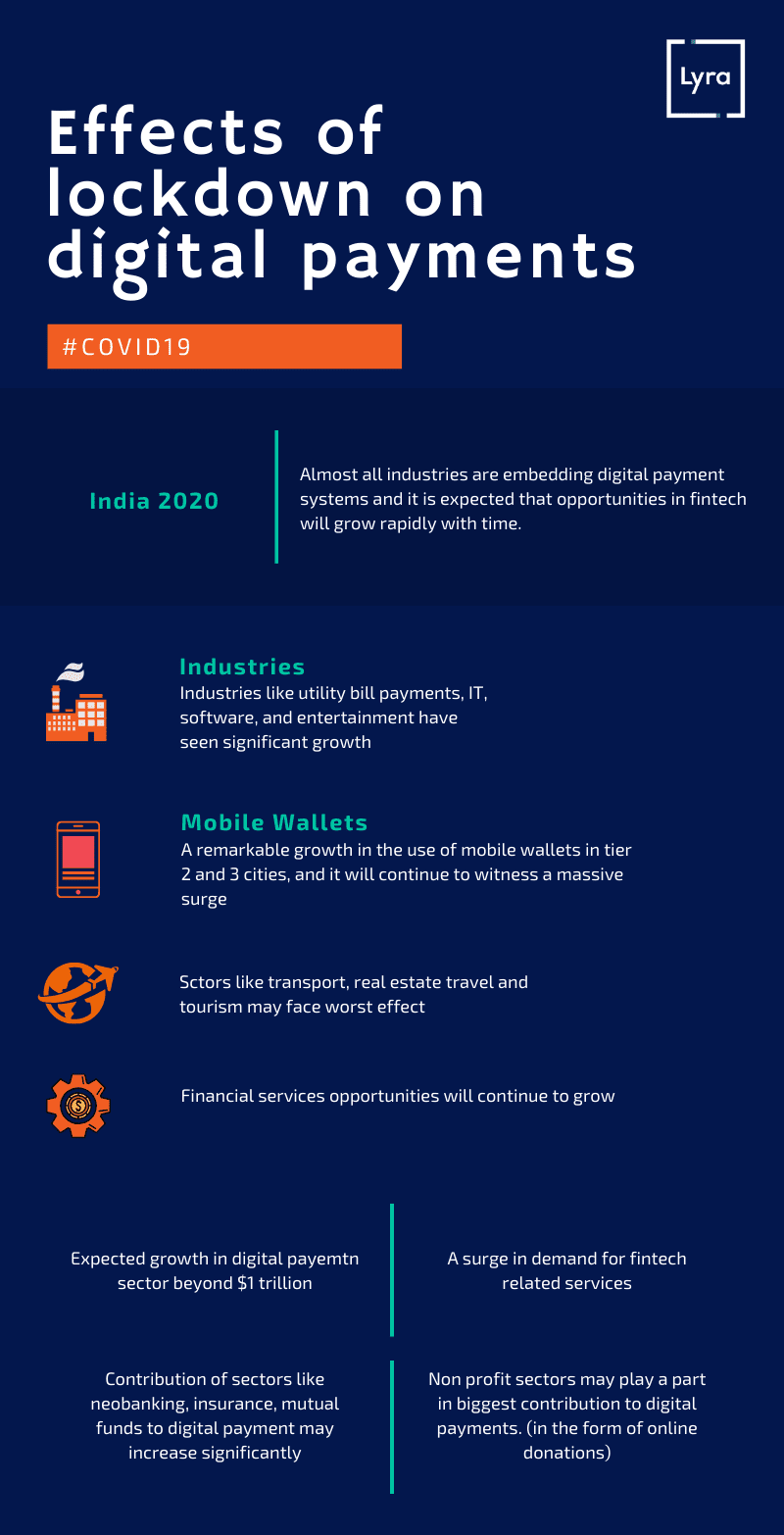

Almost all industries are embedding digital payment systems and it is expected that opportunities in fintech will grow rapidly with time.

How can Freelancers Accept Payment Online

How can Freelancers Accept Digital Payment Online How to accept online/digital payment if you are a freelancer As the world is adapting to the new...

The government has been urging to use of digital payment solutions to reduce social contact.

Many are trying to generate public awareness about the benefits of digital payments, and considering the depth of the situation, many are opting for the same.

Just recently, digital payment has soared through the roof. During this pandemic, the main sources of digital payments, i.e. business sectors like travel, tourism, malls, multiplexes, and entertainment parks faced a bigger impact.

On the positive side, this lockdown has bought many 1st time users. Many retail stores, eCommerce platforms, online gaming, broadband, and more businesses have started using digital payment means.

How can small businesses receive Digital payments

Online payments and small business How can small businesses receive payments online? The question remains popular despite the launching/...

Digital solutions have already taken the rural route. In the current situation, small towns, where digital payments had started to pick up, would also believe to take a hit.

But nonetheless, mobile penetration, initiatives by telcos, and awareness campaigns are doing their work to build a digital ecosystem that in the short and long time run can be proved to be useful.

For Infographics

Industries like utility bill payments, IT, software, and entertainment have seen significant growth

A remarkable growth in the use of mobile wallets in tier 2 and 3 cities, and it will continue to witness a massive surge in wallet transactions for bill payments

Before the lockdown, UPI at 46%, remained the most preferred payment mode and continued to be so at 43%, 30 days into the lockdown.

Boost your Business