Mobile Payment – Things You Need To Know About Mobile Payment

Accepting digital payments is not limited for online businesses anymore, be it any type of business, accepting payments online is becoming important criteria.

The COVID situation has forced us to stay inside our house and maintain social distance. The lockdown, shutting down the shops for maintaining social distancing norms and customers’ sensitivity handling the cash has somewhat stirred the whole shopping experience towards the digital side.

Keep reading to know everything about mobile payments.

What came in handy in this situation is mobile. For the past few months, there has been a steep rise in digital payments.

With the rise of e-commerce and digital transformation, mobile payments have been dominating the online payment market.

Nowadays there is a mobile application for almost everything, you can purchase whatever you want whenever you want from wherever you want.

And online payment is no exception.

Thanks to mobile applications customers are happy to shop and pay online.

To put this in perspective, statistics show that, according to the report, more than 78% of customers shop using their mobile.

Still, the fact remains, that many eCommerce websites and many shopping platforms are designed with keeping desktop/laptop in mind.

Now that mobile is becoming an essential part of everyday lives, if you run any type of business, you have to implement the payment method which allows your customers to pay with their smart devices.

Online mobile payment offers ease of use and versatility, but there is more to mobile payments than just accepting payments. Let’s learn all about mobile payments.

What are Mobile Payments?

Mobile payment is a payment made by mobile devices using an application for solutions or services.

It can be peer-to-peer, a bank transfer, digital payment via mobile wallets, etc.

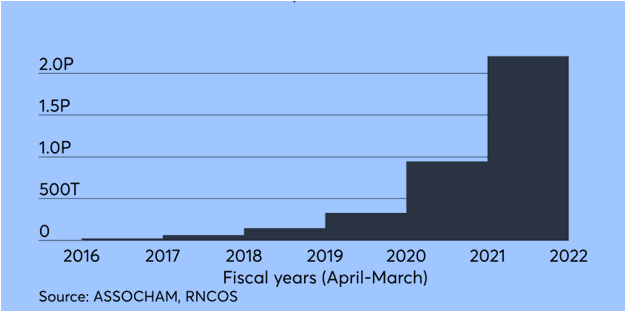

Below is a graph stating an increase in mobile payment usage.

Why is Mobile Payment Popular and Why Do Your Business Need Mobile Payments?

Mobile payment applications are secure, reliable, extremely handy, and convenient to use.

Considering the rising popularity and use of mobile applications, nearly all sectors are integrating their solutions with mobiles one way or another.

How can small businesses receive Digital payments

Online payments and small business How can small businesses receive payments online? The question remains popular despite the launching/...

Customers are with ease to use such applications and want a seamless and uninterrupted experience.

They don’t want to switch applications and want to avoid tedious processes.

Keeping this in mind, many businesses are providing a ‘one step’ kind of solution where customers can view, buy, and pay all using only one application.

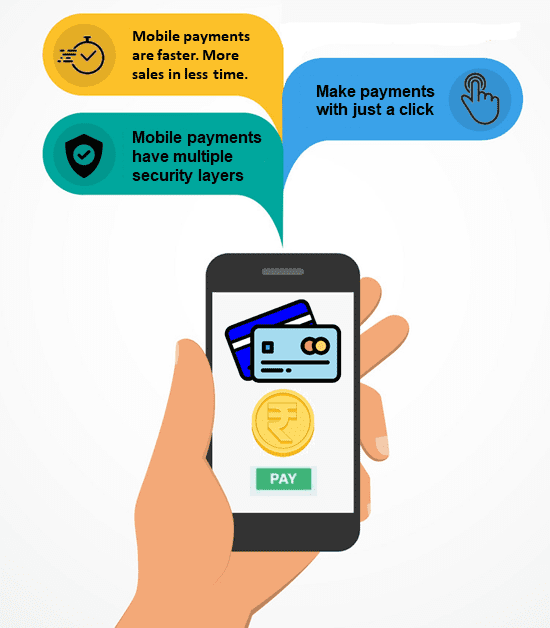

Here are some Possibilities that come with Mobile Payments

Mobile payments give a better experience to customers. A seamless checkout is one of the crucial requirements of customers.

Mobile payments offer a better checkout experience and it is convenient for customers to use.

The redirecting from site to payment option and vise versa all happens in-app itself and customers can avoid the tedious pop-up pages.

Speaking of convenient methods, customers are looking for more simplified methods, they don’t want to spend more time on payment.

Online mobile payment gives a one-click option. With the widely used ‘remember me’ option, customers can pay for services, with just a click.

Guide to Choose the Best Online Payment Solution for Your Business

Every business has different long and short-term needs. Choosing the right online payment solution that supports those unique needs can be...

After and during the transaction, you can display more offers. You can customize the whole payment form with more information, offers, display of products, dropping unnecessary steps, and increase your sales potential.

To state more simply, mobile payments are fast, convenient, and secure

Different types of mobile payments and how they work

There are different types of mobile payments. They can contact less, remote, or face to face. Here are different types of mobile payments.

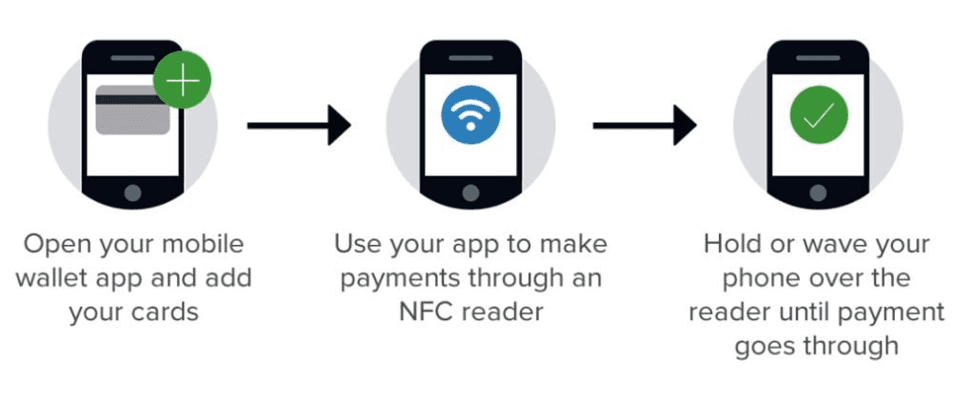

Mobile wallets:

A mobile wallet is a digital wallet which its in mobile device in the form of an application which can be downloaded and installed.

This wallet stores payment card information. The mobile wallet is preloaded with the money from your bank account as per your preference.

Mobile wallets can be used for in-store payment transactions, where the merchant is connected to the mobile wallet service provider.

How mobile wallets work:

Advantages/ benefits of mobile wallets:

A secure form of transaction

Can store debit/credit cards along with loyalty cards, coupons, etc.

They save time and efforts

Simple to use, easy to understand

Users can receive rewards

QR code payments:

One of the most preferred types of in-store payments. The use of QR-based online payments has increased exceptionally over the past few months.

For merchants, QR-based payment is easy to set up, saves maintenance and other overhead costs. QR payments provide secure and reliable payment acceptance.

Benefits of QR based payment acceptance:

Instant, on the spot payments

Easy to set up

Extremely easy to use

Secure payment solution

What is QR Code Payment and How does it Work ?

What is QR Code Payment and How does it Work ? Digital payment methods are becoming part of our day to day life. In the current events following...

Remote payments:

The current pandemic situation has forced many businesses to take an order or ‘to go’ based approach.

In such cases, face to face payments will be somewhat a difficult option. Instead, businesses have switched to remote payment methods.

Here are some popular remote payment methods:

Internet payments:

One of the popular and oldest forms of online payments is internet payments.

Nowadays we spend most of our time with digital instruments like laptops, tablets, PC, mobile, etc. they all have browsers and many people tend to simply pay on the internet browser.

Here one has to manually enter card details and then proceed to the transaction on a website in concern.

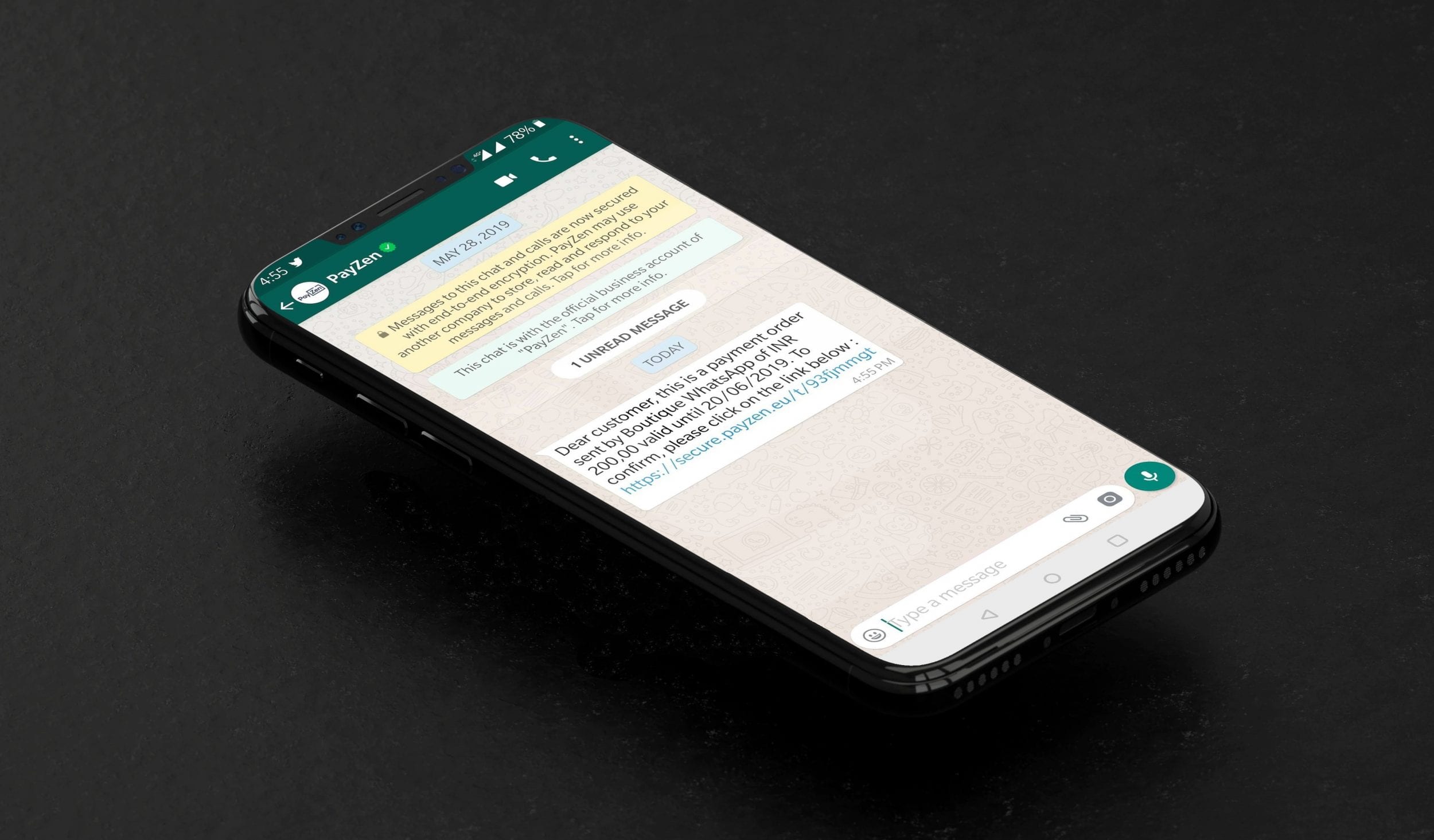

Payment links:

As the payment landscape has evolved rapidly, mobile devices have taken over laptops and PCs.

In the same sense, internet payments also have evolved in the form of payment links. In this type, the merchant sends a payment link that contains payment details to the customer over a messaging application, after receiving the link, the customer just has to click on the link and proceed with the transaction.

What are Payment links?

Making payments is all about convenience, security, and speed. India’s payment system evolved from the barter system to cash to cards to digital...

Mobile banking:

Evolution of internet banking, mobile banking is getting rapidly popular. In simple words, mobile banking is transactions conducted through the application provided by the bank.

The sign-up and transaction process varies from bank to bank. With the mobile banking application, one can perform transactions, view the balance account, and other tasks that the bank allows.

Mobile POS:

The familiar bulky, high-maintenance POS machines have slimmed down in the efficient form of MPOS.

MPOS is a mobile device or an application that performs tasks of a POS machine. Payment transactions via mPOS are generally wireless and MPOS uses various technologies to accept payments like NFC.

NFC or Near Field Communication payments have gained popularity very quickly. NFC phones communicate wirelessly with the NFC-enabled terminal using close-proximity radiofrequency.

It is a contactless and instant payment acceptance solution.

Best Epos App for 2020

If you are looking for an alternative to a bulky POS, Lyra EPOS app is a great fit for you. Many small businesses are worried about the cost and...

Essential Features for a Mobile Payment App

Online mobile payment applications offer an array of unique features. With the main goal of simplifying transactions for both customers and merchants, updating mobile payment solutions based on customers’ feedback is a must.

Here are some essential features every merchant should look for along with the compatibility of the mobile payment option/solution with the business.

Seamless transaction:

As mentioned before, the seamless transaction is one of the key features. Online payment processing via mobile provides a smooth experience.

With the facility to link credit/debit cards and save the information, the payment process becomes quick.

Convenience:

A mobile payment solution should provide ease of use for customers. Customers often avoid tedious and confusing processes and hence a simple yet interactive UI will definitely increase sales chances.

What is Whatsapp Payments & its top 9 features

For the first time in India Lyra has introduced an extremely convenient and on-the-spot online payment collection solution – Lyra WhatsApp Payment...

Simple yet interactive UI:

Speaking of UI, the flow before making the payment plays a vital role in any mobile application.

The interactive design can appeal to customers and encourage them to use, shop, and pay via mobile applications.

Better the engagement and readability of the application better the sales.

Integration with the latest technology:

People are becoming more tech-savvy. Geolocation, GPS tracking, integration with wearable devices are some of the necessary features to look for in mobile payment applications.

This integration helps save time and makes online transactions more efficient.

Cloud integration:

Speaking of technologies, the use of cloud-based technology is rapidly increasing and payment space is no exception.

With integration with cloud technologies, customers can perform secure and quick transactions.

Currency support:

Multiple as well as international currency support is one of the inevitable features to look for a mobile payment solution.

Invoicing and analysis:

Mobile payment solutions are not just about accepting payments. In addition to swift payment acceptance and seamless UI experience, there are other features like invoicing, transaction analysis, etc. which come in handy.

QR codes:

With social distancing becoming a norm, Contactless payments are in trend, and QR code is an excellent example of one such method.

QR codes are becoming extremely popular and hence this is a feature a mobile payment solution application must provide.

Reasons Retail Businesses should use EPOS App

Reasons Retail Businesses should use EPOS App Having a retail business means, you consider keeping your business up to date so as to keep up with...

Security:

A key feature of any mobile payment application should provide is privacy and security. This often comes in the form of passwords, biometric authentication, OTPs, 2FA, etc.

Benefits of Mobile Payment

Before starting accepting mobile payments, merchants should take their time to thoroughly compare the benefits and features they provide in order to figure out if the mobile payment solution would be the right fit for the business.

Convenience:

Accepting mobile payments makes it easier for customers to pay. Instead of struggling to find the exact amount of change, pull-out cards, contactless payments via mobile are preferred.

Mobile payments are fast and merchants can take their time interacting with customers which can in turn increase conversions and brand loyalty.

How can Freelancers Accept Payment Online

How can Freelancers Accept Digital Payment Online How to accept online/digital payment if you are a freelancer As the world is adapting to the new...

Overhead expenses:

Mobile payment methods are very easy to set up and reduce merchants’ overhead expenses.

For example, MPOS can replace bulky and high maintenance POS machines, QR codes enabled payment only need a QR code printed on the paper or displayed on a screen.

Security:

Mobile payments offer an extra layer of security. It makes carrying cash, credit/debit cards redundant.

Along with the cell phone lock method, mobile payments add an extra layer of security in the form of biometric authentication, PIN, OTPs, etc.

Payment options: Mobile payments can accept payments through various options, for example, card payments, internet banking, mobile wallets, UPI, etc.

All about the Benefits of Digital Payments

All about the Benefits of Digital Payments India has always been extremely comfortable with the traditional method of making payments, which is...

The Future of Mobile Payments

Mobile payments have already started dominating the digital payment space. They have revolutionized the shopping experience and clearly can be considered as a future of payment processing.

Technology is continuously evolving and mobile payments are moving forward to more secure, authenticate, and easy ways to process payments.

Advantages of Mobile payments for Businesses:

Businesses, be it any type can use mobile payment acceptance at their advantage. For example,

Mobile payment at restaurants:

We often see the link or QR code payment screen at the restaurant checkout or with the bill. Mobile payment in this scenario takes little to no time and customers can enjoy their time leisurely.

6 Reasons Why Your Business Should Use Mobile Payments

6 Reasons Why Your Business Should Use Mobile Payments The evolution of money goes from the barter system to coins, papers, plastic, and now phones,...

Mobile payments for bills:

Many utility services like gas, electricity, water have started accepting payments via mobile payment applications.

Nowadays, customers can do everything from viewing products, shopping online, paying for services online, and getting in touch with the help desk just with a single app.

Keeping this in mind and for increasing brand loyalty, many are using mobile payments.

Some of the businesses where mobile payments are used are, Schools, coaching classes, gas stations, spas and salons, gyms, travel and tourism industries, bars, cafes, social media businesses, freelancing businesses, etc.

Here are some advantages of mobile payment acceptance:

- Integrating Loyalty Programs

- Reducing Checkout Time

- Track Customer Behavior

- Ability to offer credit card payments

- Save money on credit card fees

Some common confusion:

Are mobile payments and mobile commerce the same or different?

Many of us are confused about mobile payments and mobile commerce. Most people have a vague understanding that mobile payment and mobile commerce are almost the same with some slight differences, but when we dig deep enough, we will come to know that both these things represent different ideas.

Difference between mobile payment and mobile commerce

Broadly, the majority of people have an understanding that mobile commerce is same as mobile payments, or that, “they are same with slight...

As people are getting familiar with mobile payments, demand and requirements are increasing fairly quickly.

Freelancers, retailers, and all types of businesses have started adapting to mobile payments as mobile payments are not only changing the way customers shop but also changing the way to facilitate and process payments.

How can I accept mobile payments at my store?

The two most efficient ways via which you can accept payment at your store are the following:

- Payment Links or QR Codes: Check out the product here

- WhatsApp Payment Solution: Check out the product here

Boost your Business

Let us help you find the Best Payment Solution for your Business

Read more about the latest trends in fintech here