Broadly, the majority of people have an understanding that mobile commerce is same as mobile payments, or that, “they are same with slight differences”. But if we dig deep enough, we will come to know that both represent different things/ideas.

Are they different? Are they same?

So, what is the difference between mobile payment and mobile commerce?

Consider the following situations (don’t worry, every situation starts with shopping, and who doesn’t love shopping)

- You initiate buying/commerce via mobile but pay cash on delivery. {Mobile commerce}

- You initiate buying/commerce at the store but pay via mobile (to get those rewards, am I right?) {Mobile payment}

- you initiate buying/commerce via mobile and pay via mobile (a win-win situation, who needs to leave the house?) {Mobile Commerce and mobile payment}

These examples are exactly why many of us are confused by both of the terms.

And yes, as you see, they are very much different.

Let’s start by defining them.

What is mobile payment?

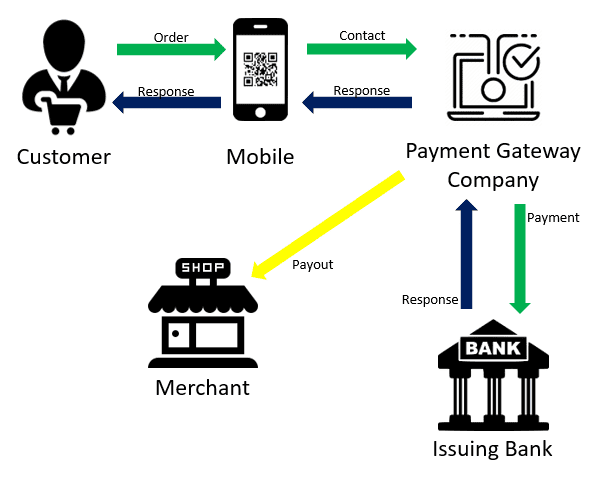

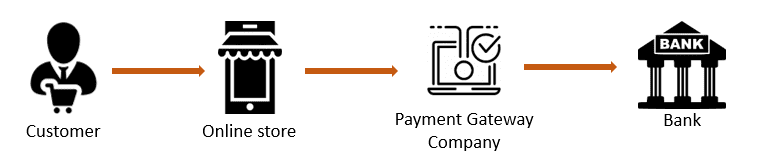

The mobile payment system, as the name suggests is making payments using a mobile. Going one step ahead, a mobile payment solution can be a transaction/payment which is initiated on the mobile. So, instead of paying via cash or swiping a credit card, a customer needs to pay via mobile. The online transaction process has many parts.

After initiating the transaction on a mobile device, the next step is an authorization of the transaction and facilitating the transfer amount from the customer’s account. And all this in real-time.

Also known as mobile money transfer these payment services operate under government finance regulations.

The Future of Payment Gateways

The Future of Payment Gateways Payment Gateways in Today’s time In today’s time, As online payments are becoming more and more popular means of...

How mobile payment works?

What is mobile commerce?

Mobile commerce can be defined as electronic sales and commerce done by mobile(It can be said that mobile commerce is an adaptation/advancement of eCommerce). Getting more to the basics, M-commerce is buying and selling goods and services via mobile devices. If the commerce is initiated via mobile, it is m-commerce, making a place or time insignificant.

How mobile commerce works?

Why do we need them?

Mobile dominance and dependence are increasing and many mobile payment applications are being developed which allow consumers to pay conveniently. M-commerce and m payment can be done from anywhere and anytime which redefined the shopping experience. Cashless transactions are becoming a new trend and both of these can be considered as the major business growth influencers that can not be ignored.

Advantages/benefits of mobile payment systems

One-click Payments:

No one has time in their busy lifestyle and people prefer that their mobile remembers them, their preferred payment method and that they can buy any service/solution with just a click. Online mobile payment offers a quick check-out process that customers can customize themselves.

Fast payments:

Searching for a change and not finding any or waiting for a chip card transaction only to find out it is unsuccessful can be embarrassing. Payments via mobile can be done anytime from anywhere and they minimize the time spent while performing a transaction. Mobile payment simplifies the transaction process not only for the customer but also for business owners.

All about the Benefits of Digital Payments

All about the Benefits of Digital Payments India has always been extremely comfortable with the traditional method of making payments, which is...

Secure mode of payment:

Paying via mobile renders the need for carrying the cards or a huge amount of cash with you all the time. It enhances payment security by adding more security layers like biometric authentication, 2FA (two-factor authentication)

Advantages/benefits of mobile commerce

A better customer experience: It provides customers with a better shopping experience by giving,

- Competitive pricing

- On the spot buying

- A variety of products

More than just buying and selling: M-commerce provides

- Mobile banking

- Utility bills payments

- Stock market trading

- Mobile ticket booking

It helps businesses target their customers according to various criteria

It gives an omnichannel experience

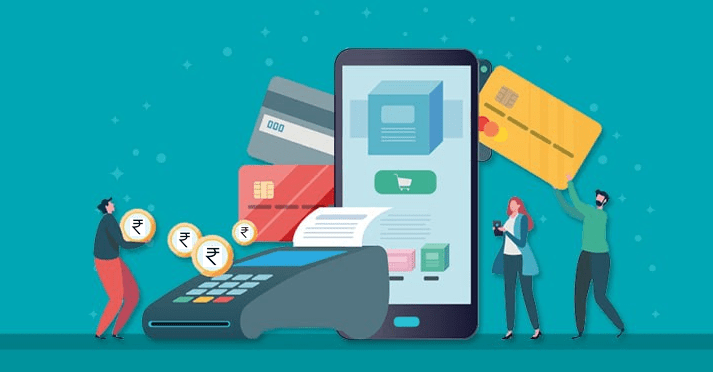

Types of mobile payment

NFC payments: NFC(Near field communication) payments is a contactless form of payment that uses NFC technology is used to exchange information between payment devices. NFC-enabled payments need a reader device that can accept contactless payments. These payments are secure as they use dynamic encryption.

MST payments: In MST (magnetic secure transmission) payments, mobile emits a magnetic signal which is then identified and picked up by a card terminal. This method uses a tokenization system making it one of the secure contactless payment acceptance methods.

QR code payments: QR (quick response) payments are one of the popular types of online mobile payment technologies used throughout. In this mode, payment is done by scanning the QR code with a QR scanner app or mobile cameras. It is equivalent to the POS system, without a POS machine.

Mobile wallets: mobile wallets are becoming pretty popular these days. They are pre-loaded with cash and truly provide a one-click seamless payment option. Payments via mobile wallets are faster and more convenient.

Mobiles as credit card terminals: In this, mobile devices are used as a reader for credit cards to accept payments. Payment done via this method is secure fast and beneficial for small or home-based businesses.

Mobile web-based payments: This is the mode via which, a customer can access web pages through the mobile or using a mobile payment gateway

Adopt these Nine and make your business outshine

Offerings the best payment gateway should provide to boost the reliability of your online business’s payment flow. While you sit and wonder what...

Types of mobile commerce

- Food delivery apps

- Restaurant booking apps

- Ticket apps

- Retail store apps

- Social apps

- Gaming apps (in-game purchase)

- Banking apps

The future of mobile commerce and mobile payments

The future of mobile commerce and mobile payments looks brighter than ever.

According to a report, The mobile payments market was valued at USD 1139.43 billion in 2019 and is expected to reach a value of USD 4690.65 billion by 2025, at a CAGR of 26.93% over the forecast period of 2020-2025.

Here are the reasons:

- The number of mobile users is increasing day by day and it is becoming a necessity for everyone in social, personal and business life.

- Mobile devices have a great influence on consumers

- Instant access to the internet and simple to use mobile payment apps making the shopping experience more convenient.

- Both mobile commerce and online mobile payments can help a business by getting a larger and global market