6 Reasons Why Your Business Should Use Mobile Payments

The evolution of money goes from the barter system to coins, papers, plastic, and now phones, i.e. digital money. Demonetization played a very big role in replacing physical wallets with a virtual wallet known as a mobile wallet(or m-wallet). Mobile wallet, in simple terms wallet in your mobile, is considered as one of the best innovations in the technological field and the mobile payment market is gaining momentum.

A smartphone is becoming one of the “basic needs” for people. It is changing the way how people live, travel, eat, and now the way they make payments. This is why businesses should embrace mobile payments.

What is a mobile money transfer?

Mobile payment or mobile money transfer is a transaction where payment is initiated via mobile.

Difference between mobile payment and mobile commerce

Broadly, the majority of people have an understanding that mobile commerce is same as mobile payments, or that, “they are same with slight...

What are the current payment collection problems?

Every business has its own set of problems when it comes to accepting payments. These problems are majorly based on the business modules. Some of the businesses require to accept payments in installments, some of them are required to accept some percent of payments in advance, and some of them even don’t have a website or online store but still need to accept online payments(maybe due to transportation problem), etc.

Here are some of the challenges faced by small businesses:

- Payment collection orders are always changing and so are the invoices and receipts.

- There is a lack of compatibility between payment acceptance solutions.

- Many businesses need an external physical device or a third-party application to accept money/payment online.

- Growing security and fraud concerns about transferring /transacting online.

- Provision of the payment methods requested by customers.

What can a mobile money transfer App Accomplish?

Everyone and anyone have a mobile, it is one of the ‘basic needs nowadays. So accepting payments via a mobile application that caters to all the business needs is the solution. It is easy for merchants and customers will surely enjoy the convenience!

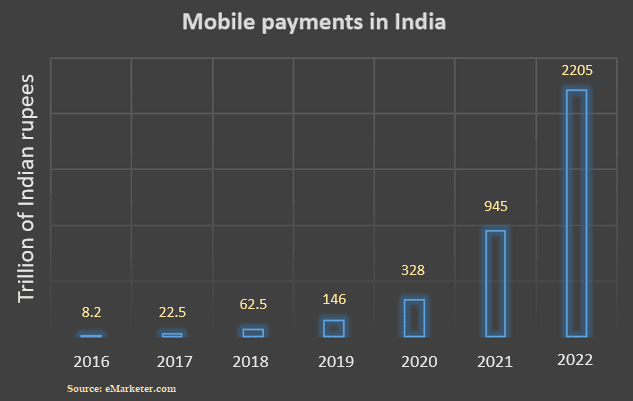

Mobile money transfer are in demand

The growing demand for mobile payment can be considered a driving factor for digital India. With the variety of applications available along with UPI and BHIM, RBI forecasted a 50% increase in mobile-based transactions in its 2021 vision document.

Here are the top 6 reasons why small businesses should adopt mobile payment technology

1) Mobile payments are convenient

Online Mobile payments are convenient, for customers, merchants, and the staff working for the merchant.

With mobile payments, customers get lower waiting times, fast checkout, and eliminate the need to carry physical wallets. This helps in increasing customer experience and satisfaction.

Transactions with online mobile payments are a lot quicker and people have their mobile devices by hand(literally) which makes mobile payments the most convenient way.

2) Mobile money transfer are secure

Mobile payments are secure as they have multiple security layers including dynamic encryption. Various advanced methods are being integrated to make these transactions secure and keep sensitive credit card information safe. With security measures like PIN, biometrics, etc. mobile payments are considered to be more secure than EMV chip card payments.

3) Mobile Payments can boost your sales and expand your business

Online Mobile payments allow your business to accept payments online, virtually anywhere, expanding your business footprint. These tools save your time fumbling with cash and trips to the bank. Which in turn allows you to focus on providing excellent customer services and boosting sales.

How can small businesses receive Digital payments

Online payments and small business How can small businesses receive payments online? The question remains popular despite the launching/...

4) Mobile Payments offer powerful management tools

Mobile payment services offer different management tools. From bookkeeping to tracking and managing the transactions, generating and sharing the invoices, generating and sharing digital receipts, data entry, etc. with the help of mobile payment applications, businesses can track the customer trends and inventory. Merchants can use this information to understand customer demands and improve services and increase sales.

5) Mobile Payments can improve the customer experience

Using mobiles to accept payments makes it easier for customers. It provides an opportunity for customers to pay at any time and it speeds up the checkout process, impacting the entire customer experience. It allows engaging with customers, which is an essential step for increasing brand loyalty.

6) Mobile Payments can reduce merchant’s expenses

Mobile payments allow you to send and accept money via mobile. It eliminates the need for any physical devices that need to accept the payments. A merchant’s mobile can be converted to a POS or card reader just by installing an application. Merchants can send invoices and receipts via email or share them via messaging app eliminating the need to print them and subsequently need for paper and ink. By accepting mobile payments online, businesses can reduce bank charges and overhead costs.

Guide to Choose the Best Online Payment Solution for Your Business

Every business has different long and short-term needs. Choosing the right online payment solution that supports those unique needs can be...

Why mobile money transfer are not picking the pace

1) Security concerns

As mobile money transfer technology is evolving, so are the hackers. Security is and always will be a top concern among merchants and customers.

2) Lack of awareness

Many customers, as well as merchants, are unaware of mobile payments, the lack of awareness is majorly related to security, data privacy, etc.

3) Acceptance

India is a country with a growing number of businesses. Not all merchants need to accept mobile payments. (It is a high chance that they accept digital payments, but not mobile payments)

4) Slow adoption

Some customers still believe that making payments via cards or cash is better than paying via mobile application. They prefer using traditional forms of payments or using credit or debit cards.

5) Tracking the transactions

Every transaction made by mobile payment leaves a digital track, raising questions about privacy.

6) Number of mobile payment applications

70+ applications provide payment acceptance via mobile and many more are in the development is a high chance that the merchant accepts some form of mobile payment but not the one that the customer uses, or vice-versa.

Learn how whatsapp can eliminate this problem

7) Mobile

This one is pretty obvious, all the transactions done via mobile payment are tied to the mobile users in those transactions. If that mobile is stolen or lost or even runs out of the battery……….

Summing up,

Mobile payments create a positive and better customer experience and can help to build a better customer relationship. They are becoming more and more customer-oriented and let’s hope that mobile payments will show an increase of two to three-fold coming years

Best Epos App for 2020

If you are looking for an alternative to a bulky POS, Lyra EPOS app is a great fit for you. Many small businesses are worried about the cost and...