Don’t we all hate to see a screen screaming at us ‘Payment failure, please try again’? The agony of going through the whole procedure of online payment (though it takes a couple of minutes) exhausts us.

And when it happens more than one time, many customers just leave the shopping and move on to the next web-shop.

As digital payments are becoming a standard platform for receiving payments, a merchant who accepts online payments or owns an eCommerce shop, this is an issue that should not be overlooked, as it can cost the cart abandonment and you may lose a customer and with that revenue.

So, Why Exactly Do Online Payments Fail?

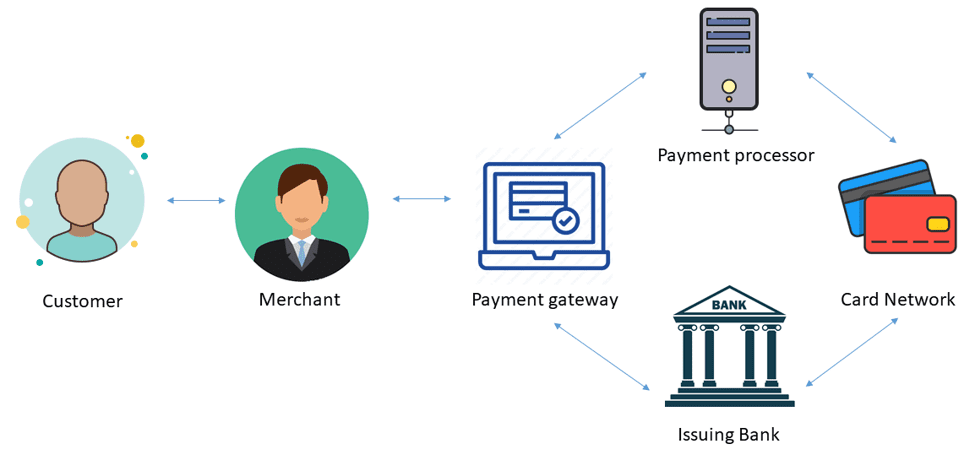

To understand how payments fail, let’s first quickly understand how online payments get processed.

All About Payment Processing

sAll About Payment Processing In this digital age, everyone is favoring online payments. With the benefits of digital payments, merchants, as well...

Types of Payment Failure

Broadly payment failures can be classified in different types depending on the category.

Here are some classes:

- Payment failure from the customer’s side and payment failure from the merchant’s side

- Payment failure when the amount is charged and payment failure when the amount is not charged.

What Are the Reasons for Payment Failure?

From the customer’s side payment failure can be caused simply because there is a poor connection or due to inputting incorrect details, inputting incorrect OTP, passwords, or due to lack of sufficient funds in the customer’s account.

From the merchant’s side, it gets more complicated and hence it is important for any merchant to understand why online payments fail.

Technology failure

As you can see in the above online payment processing flow diagram, payment processing includes several steps through which customers’ payment gets debited from their account and gets credited in the merchant’s account.

When customers initiate the payment, they need to choose a payment method, e.g. credit card, net banking, etc. after choosing an online payment method customers put in required data e.g. username, password, CVV, etc.

This data is then sent to the payment gateway which then transfers it to the card network. After the authentication and verification of all details, the amount is transferred to the acquiring bank and then to the merchant’s account.

Even a slight failure in any of these steps can cause online payment failure.

Downtime

Online payment processing involves entities like acquiring bank, issuer bank, payment gateway, payment processor, etc. These entities have their own downtime, scheduled, or unscheduled.

If any of the above-mentioned entities are in downtime, the server can’t reach them and can’t get approval for the transaction. This can cause online payment failure.

Guide to Choose the Best Online Payment Solution for Your Business

Every business has different long and short-term needs. Choosing the right online payment solution that supports those unique needs can be...

Security

Detecting online payment fraud is an ongoing battle fought by nearly every entity that is involved in online payment processing.

Every bank, for example issuing banks, is equipped with aggressive and advanced fraud detection technology and fraud analysis tools.

These tools analyse and verify if the coming transaction is authenticated or not based on the spending patterns. If the pattern does not match, these tools can block the transactions and decline them.

In this case, these are some red flags that cause the transaction to be declined.

- A security threat from the side of an issuing bank.

- Many merchants have an upper limit on transactions and the transaction amount more than the limit can be declined by the payment gateway.

- There is a blacklist of BIN numbers. BIN is the Bank Identification Number presented on the card. If the transaction is initiated through the blacklisted BIN, it can get rejected.

Here are some other common reasons for payment failure

- Misconfiguration of payment gateway.

- Transaction blocked by the merchant account.

- Expired credit/debit card.

- Canceled credit/debit card.

- The online payment method chosen by the customer is not supported by the payment gateway.

- If the customer’s account is flagged by the bank.

- If the account through which the transaction is initiated is closed or suspended.

- Invalid billing address.

- Transaction via maxed-out credit card.

Here are some error messages customers get after payment failures:

- Transaction cannot be authorized: Incorrect OTP or Password

- Signature validation failed: When the 3d signature is wrong.

- Payment not captured: Insufficient balance in the account or due to incorrect CVV.

Online payment failures are not entirely avoidable. Understanding the reasons can help you make payments in a much easier manner and tackle customer’s complaints.

Boost Your Business

Let Us Help You Chose Best Payment Solution