Demand for online payment processing is increasing and so are the problems because ‘Online Shopping’ is here to stay!

And it is not related to shopping anymore, people can do much more than just shopping, they can,

- Pay their utility bills

- Book movie tickets

- Book and pay for restaurant

- Pay for other services via online banking or mobile payments applications

Why do people love to shop online? It is easy, quick, they have a lot (and I mean a lot) of options. Customers can do this while traveling, sitting in the office or while relaxing at home. Shopping online as well as paying online for services meets one of the most critical and important criteria in today’s day and age: Do it from anywhere at any time.

What is an online payment processing platform and how does it work?

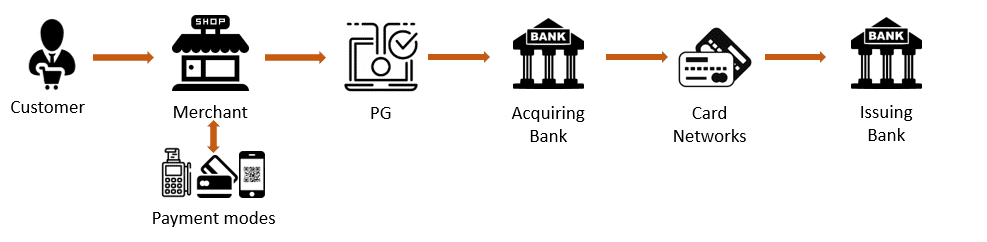

In simple terms, payment processing is automated transactions between the merchant and the customer. Merchant account, payment processor and payment gateway are the three major components of any online payment processing platform. Other entities involved in the process are customer, merchant and their banks.

Here is an image explaining online payment processing steps:

Online business owners are paying attention to the modification and up-gradation of their payment acceptance process to provide customers with a unique, secure and swift buying experience. Setting up and improving such an online payment process with continuous monitoring can be challenging.

Despite the technological advancement in online payment processing and increasing demand from customers for payment features, there are still some unique challenges.

Online payment processing steps:

- The transaction is initiated by a customer

- Payment gateway transfers the transaction to the processor

- Processor approves the transaction after verification

- Customer’s bank transfers the money to the processor

- Processor transfers the money to the merchant’s account/bank

- The status of the transaction (either approved or failed) is sent by the processor to the payment gateway

- The merchant receives the status of the transaction through the payment gateway

- If the transaction is successful, the merchant receives the payment

Online business owners are paying attention to the modification and up-gradation of their payment acceptance process to provide customers with a unique, secure and swift buying experience. Setting up and improving such an online payment process with continuous monitoring can be challenging.

Despite the technological advancement in online payment processing and increasing demand from customers for payment features, there are still some unique challenges.

List of Common Problems in Online Payment Processing

Collecting money/ payments online is not always easy, it can be confusing and sometimes risky, many online service providers are upgrading their systems to deliver perfect service, but some problems are just inevitable. Here is a list of common problems for Online payment processing on Business website

Choosing the Best Online Payment Solution

Problems start with choosing the best online payment processing solution for the business. Choosing the right solution depends on a variety of factors and every factor has its own importance. Making the right choice of payment solution will help you improve your brand and increase revenue. Here is the guide on how to choose the best online payment solution for your business.

Fraud

The online payment processing system is evolving and so are the fraudsters. It is the reality of the internet age. Though payment solution providers are implementing and improving the techniques to keep the data safe, fraudsters are constantly looking for loopholes to breach the security. The most common types of frauds are data theft, phishing, and charge back.

- Data theft is a common fraud practice. The hackers can steal sensitive card details. The stolen credit/debit card data can be used for committing fraud. Payment gateways and websites mostly used encrypted data or methods of tokenization to prevent data theft.

- Phishing is a practice of sending fraudulent emails or messages claiming from reputable and legitimate companies in order to steal one’s personal information like username, passwords, credit card details, etc

- Chargeback is a return of money to a consumer. It is a major challenge for merchants which can impact brand equity. Also known as friendly fraud, this is a practice of ordering items/services online and then initiating a chargeback claiming that the purchase was made fraudulently. Chargebacks often cause gross merchandise value losses and business can face a negative impact.

How to Test your Payment Gateway Integration

Importance and Intricacies of Testing the integration of Payment Gateway Considering the importance of a payment gateway for any e-commerce...

How to fight it:

- Assessment to identify vulnerabilities

- Using PCI DSS compliant solutions

- Implementation of tool which can identify customer behavior patterns

- Implementation of tool which can identify and prevent fraud

- Audit of online payment system/solution

- Anti-fraud tools

- The excellent customer support which can respond to customer queries as soon as possible

Security issues – Customer’s trust

What comes hand in hand with fraud is security. If a customer is trusting an online business with their money and information for a purchase, it is a merchant’s responsibility to maintain that trust and provide them with a secure and seamless buying experience. A business needs to guarantee customers’ safety and that their information is safe with the company.

How to fight it:

- Proactively developing new security solutions

- Using customer validation services

- Tokenization

- SSL certificate on the website

- PCI-DSS Compliance

- Two-Factor Authentication

What is Payment Switch - Working, Architecture, Features, and Benefits

What is Payment Switch - Working, Architecture, Features, and Benefits Simply said, Payment Switch is a tool that facilitates communication...

Technical integration

Most of the business owners don’t have the technical knowledge which is needed to integrate payment solutions with the business website. They are unaware of API integration, drag and drop or developer option. Hence, integration becomes a painful and difficult time-consuming process for them. With the number of regulations and complexity of the system, integration can cost more for many small business owners. Integration should be simple and accept all kinds of payment options

Solution: Choose a payment solution provider who can provide a simple to integrate and time effective payment acceptance system with a seamless experience. Pick the solution that doesn’t require additional software.

Omni-Channel Payments

Payment modes: Customers prefer different methods to transact online, the methods they are more comfortable with, like, mobile wallets, net-banking, cards, etc. so, it is important to have a processor that can accept all local and global payment acceptance modes.

Payment channels: In the age of the internet, every business needs the ability to accept payment via all online channels be it over a website, mobile or social media.

Payment currency: The Internet is bringing the world closer and closer, and customers can buy from wherever they want. Accepting multi-currency can attract customers and can be beneficial for the business. And with the major players in the online payments acceptance business introducing their specified currencies, the solution needs to be interoperable.

What is Payment Gateway and How does it Work

What is Payment Gateway? A payment gateway is an online payments service that, when integrated with the e-commerce platform, is devised as the...

Processing Fees

Setup cost and Processing cost is an important decision making factor for any business that wants to implement online payment acceptance solutions. These fees depend on various factors like methods used for accepting payments, transaction volume, etc.

Solution: Finding a solution/service that will cost less and has a simple fee structure that will be profitable for a business.

The online payment industry is getting more and more active and there are lots of payment services provides available in the market. Not every business owner has all the knowledge about pitfalls and online payment processing problems. It is important to choose a solution based on business needs.

For a solution that tailor-made for your business, contact us.

Go digital, start accepting payments online and increase your customer base and profits.