Making payments is all about convenience, security, and speed. India’s payment system evolved from the barter system to cash to cards to digital payments.

Each system is more convenient and advanced than before.

Small business owners or startups who don’t have e-commerce websites needed a secure solution where they could collect online payments and manage their transactions along with boosting their sales and growing the business.

And customers would prefer if they don’t have to download and log in to different online payment applications each time they want to make an online payment.

So, As the payment modes evolved both customers and merchants started to look for a more seamless way of making payments, and thus, payment via links came into the picture.

What is a Payment Link?

In simple terms, a payment link is an online payment method where a request for online payment is generated and shared by the merchant to the customer, to make instant online payments.

Accepting payments via link sharing is the easiest and fastest way for both customers and merchants. The payment collection is done either via the payment link or a QR code.

How do payment links work?

Generate a payment link, share the link and collect payment instantly, it’s as simple as that.

To elaborate further,

- Merchant generates a payment link

- Merchant shares the payment link

- The customer gets the link

- Customer clicks on the link

- The link then redirects the customer to the secure payment page

- Customers make an online payment with offered methods(wallet, UPI, cards, net banking, etc)

- Merchant gets notification after successful payment.

How can small businesses receive Digital payments

Online payments and small business How can small businesses receive payments online? The question remains popular despite the launching/...

Benefits of payment links for merchants:

Security:

Creating and sharing a payment link is backed with a secured payment gateway. Most payment link solutions come with fraud and chargeback handling and assist merchants and customers with hassle-free transactions.

Reduce overhead cost:

Accepting payments via link eliminates the need for any external physical payment acceptance devices (like POS terminals) or any third-party application.

This saves time and cost for installation, maintenance, and training.

Customized messages:

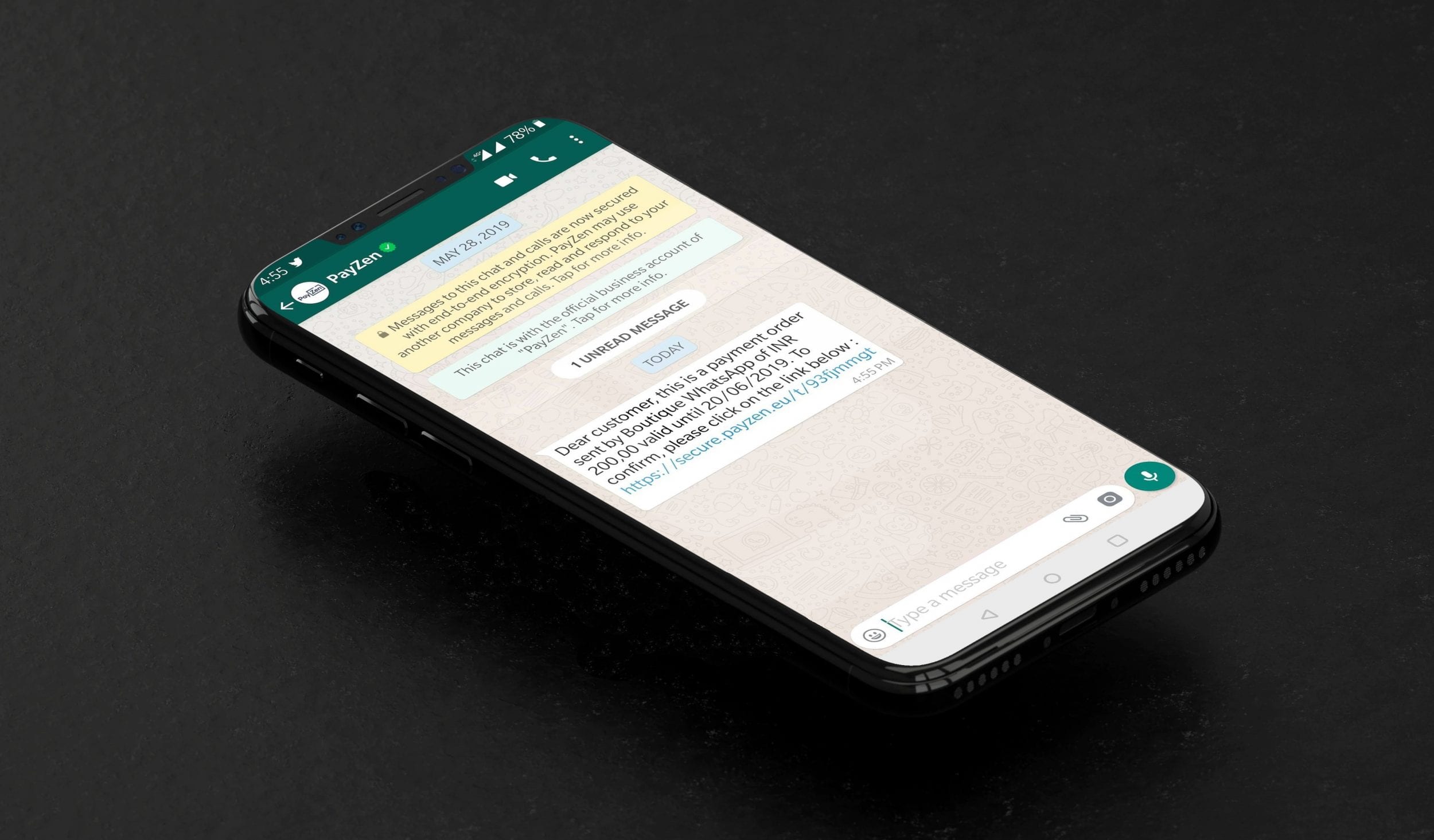

Payment links can be shared on any social media or messaging platform, Merchants can attach a customized message while creating a payment link to attract customers, to promote other products, etc.

Bulk orders/ split payments/ EMI Payments:

Accepting payments via payment links allows merchants to create payment links for flexible, variable payment orders, or accepting payments in installments.

Better customer experience:

Accepting payments via link sharing caters to the need of an Omnichannel business, as it is always available on the merchant’s mobile phone.

Payment links offer on-the-spot payments with faster transaction rates.

This improves the overall customer experience contributing to an increase in revenue.

Happy Customers

Payment acceptance via link sharing improves the service level and increases convenience for merchants as well as customers.

With flexible payment links, customers can pay from wherever they want with the preferred payment option.

It increases customer satisfaction and can be used to build a loyal customer base.

Give your customers the flexibility to pay and they will surely love to shop with you.

What is Whatsapp Payments & its top 9 features

For the first time in India Lyra has introduced an extremely convenient and on-the-spot online payment collection solution – Lyra WhatsApp Payment...

Benefits of payment links for customers:

Customers Don’t Need an additional App To Pay:

There are many digital payment service providers in the market and people use the application they find more convenient.

The customer need not have the application merchant is using for payment collection. On this off chance, there might be some issues.

Payment via payment link is an easy solution for this problem. Customers don’t need to install and login to any additional application, as these links are shareable via the messaging platform.

Multiple Payment Options:

Payment links service providers offer a wide variety of payment modes. Customers can choose any mode they are comfortable with.

These modes include payment via net banking, credit cards, debit cards, UPI, mobile wallets, etc.

Security:

Payment links are backed with a secured payment gateway.

All payment link service providers make sure that their solution complies with government norms in regards to customer data security.

The applications come with 3ds protocol and PCI DSS compliance.

If the customer is using mobile payment, it just adds an extra layer of security like 2FA, biometric, PIN to make payments via sharing links secure

Make payments from anywhere:

With payment links, customers can make payments from anywhere. It doesn’t need to be the on-the-spot payments, via payment links, customers can pay from their homes, offices, from anywhere they want and at any time they want.

Payment link-based transactions give customers the flexibility to make payments.

Flexible omnichannel experience:

Offer full payment flexibility, accept a down-payment in-store then follow up for the rest with a payment link on any sales channel.

This gives customers a great shopping experience without any interruptions.

Recommended: Replace your POS machine with Epos Payment Link Application

Payment links are used by, used for:

Generating and sharing payment links for payment acceptance is perfectly suited for all businesses, online and offline.

Payment links for Businesses without a website:

Small merchants like tutors, catering service providers, consultants, etc that do not own a website. Payment link sharing is the easiest option to collect payment in this case.

Payment links for Social media stores:

Payment link sharing is the easiest option to collect payment from the customers. It builds credibility and trust among customers.

Payment links for Shopping stores:

Payment links can be useful to eCommerce business, travel, and tourism business, shopping stores, retail businesses.

And many more like the Insurance business, Financial services business, Manufacturing business, Education business, Pharmaceuticals business, Healthcare business, etc

Payment links can help businesses, how?

Abandoned carts:

Increase revenue – complicated checkouts often lead to cart abandonment. Customers prefer a simple and easy checkout or payment.

Payment via link is fast and allows customers to make online payments easily. Accepting transactions via payment links reduces chances for incomplete payments and card abandonments and leads the way to increase your Sales Success.

Pay on Delivery:

Many businesses offer home delivery options. In these cases accepting payments via a link can be beneficial for both merchants as well as a customer as the money will get directly deposited in the merchant’s account eliminating any third-party interference.

Broadcasting the link:

Merchant can generate a payment link and share it among their customers to collect bulk payments (payments from multiple customers)

Recommended: Generate Payment Links using Whatsapp

Social Commerce:

Many merchants run a business on social media channels like Whatsapp, Facebook, etc. As payment links can be shared via any social media channel, they offer payment flexibility and provides customers with an instant payment option.

Transaction management:

Merchants can keep track of all transactions.

How can you get started accepting payments via links?

All payment link service provides have a more or less similar procedure, which is:

Follow this procedure:

- Install application from an online store (google store, app store)

- Get on board with the service provider (you have to submit required documents)

- Start accepting payments via payment links

Didn’t get what you were looking for?

Contact Us, we will be happy to help you

Read about the latest trends, news, and fintech updates here