What is QR Code Payment and How does it Work ?

Digital payment methods are becoming part of our day to day life. In the current events following covid19 and lock-down, most of the shops are now accepting digital payments and one of the most widely used payment acceptance solutions is online payments via QR codes.

We can witness QR codes in all types of shops like stationery, medical, dairy, supermarkets, etc.

One of the reasons they are becoming popular is payment acceptance via QR codes follows the norm of social distancing. Customers, as well as merchants, can deal with this payment solution without entering proximity.

Giving out mobile numbers or billers code may lead to fraud. Using QR codes eliminates this possibility.

QR codes are easy to generate and customers don’t need any additional hardware to pay via them. Just a smartphone with a camera is enough.

So, what exactly are these QR codes? What are its different types? How does it work? What are its benefits?

Here is everything else that you should know about the QR Codes.

What is a QR code?

QR codes, which look like this,

QR Code full-form: Quick Response Code.

It consists of a pattern of black barcodes or squares arranged in a square grid on a white background.

These codes can be read through the QR code scanner. Nowadays many mobile cameras come with inbuilt scanners.

They are similar to barcodes, the difference is, QR codes can store a large amount of data compared to barcodes.

How does QR code work?

QR codes generally create a sort of pixel pattern with each part containing a piece of information. In the case of digital payments, the information can be, merchants’ details, transaction details, etc.

Upon scanning, QR code patterns (horizontal and vertical black patterns on white background) get decoded by the software and get converted into the character string.

The Qr codes (for payment acceptance) generally carry commands related to transactions.

Merchant can generate QR codes for his shop, or for any fixed or variable amount. According to this command, the QR code is generated. It either opens a payment link, confirms payment, or does any other operation as specified.

The customer just has to scan it and then transfer payment.

To scan QR codes, you will need,

A barcode reader/ QR scanner.

A smartphone with an inbuilt camera.

(Nowadays, there are many apps with which, QR codes can be scanned with utmost ease)

It works as simple as that.

Whatsapp payment for Businesses and freelancers

Whatsapp payment for Businesses and freelancers A guide for freelancers and small businesses to use WhatsApp payment solution for online payment...

Advantages of QR code

Although similar to the linear barcodes we see on products in shops, the QR code has four important advantages:

It stores a large volume of data.

It can be scanned from a screen or from a paper.

It can be read even if part of the code is damaged.

It’s safer because information can be encrypted.

Characteristics of QR codes

The main characteristic of the QR code is a set of three squares placed in three corners. The overall size of the matrix can vary. Smaller the matrix less the information and larger the size more the information.

As the QR code is two dimensional, it contains more data than a one-dimensional bar code.

QR code can store up to 4,296 alphanumeric characters and unlike a barcode, it is two dimensional, meaning it can be scanned in any direction and thus can contain more information than barcode.

Since QR codes contain more data, they allow for encryption that is useful for payment processing.

Types of QR Code

There are two types of categories for QR codes:

Static QR code:

Static QR code contains the Payment URL directly placed inside. As these QR codes are static, the content of the codes can not be altered and these codes also can not be tracked.

They are used for quick and simple online payment acceptance. Customers just have to scan the QR code, enter the purchase amount, the merchant will verify the details and then the customer can initiate the online payment.

We often come across such codes at small shops, at restaurants, hardware stores, medicals, in-store retails, etc.

Dynamic QR code:

Dynamic QR code offers a better payment experience for both customers and merchants. It is editable and comes with extra features like password protection, scan analysis, etc.

A merchant can find out various details like how many people scanned the code or what type of devices were used for scanning, etc. dynamic QR code conveys the purchase amount and merchant information.

In this case, the customer just has to accept the transaction through the QR code application.

What are Payment links?

Making payments is all about convenience, security, and speed. India’s payment system evolved from the barter system to cash to cards to digital...

How do QR code payments works?

As mentioned before, QR codes are proving to be one of the best online payment acceptance solutions for merchants.

Customers just have to scan the code using a smartphone camera. These codes can be scanned from the display screen or from paper.

QR code payments can be done in the following ways:

Using a smartphone for scanning the code displayed on the shop’s checkout, products, website, etc., and making online payments.

You can just scan the QR Code, provided by the merchant, using your smartphone (your phone must have a camera). Usually, you would be using an app that allows you to scan the QR code and proceed with the payment.

In the case of POS– the fixed amount is displayed on the retailer’s POS system at checkout.

Both customers and merchants use apps for online transactions. Merchant generates QR codes via a mobile app. The customer scans the code via his/her app and on confirming the amount proceeds to the transaction.

The merchant generates both the invoice of a particular amount and the QR code. He then displays the QR code on the screen of the smartphone.

Benefits of using QR code payments

On-the-spot payments:

Not only do QR codes facilitate instant payment, but online payment can also be extremely quick compared to other methods. A customer just has to open the QR code application to scan the code and pay.

After confirming the payment processing, payment is done within a few seconds.

Saves overhead costs:

The merchant does not need to buy any third-party hardware like a POS machine for payment acceptance.

Though mPOS costs much less than physical POS, there is still some cost involved in the form of purchasing, maintenance, and training. Compare to that payment acceptance via QR can be considered a complete turnover as it just requires a scannable QR code, whether on screen or on paper.

It is a readily available solution and it reduces the need to input any transaction-related data making it a ‘hassle-free’ solution.

Secured online payment:

Using QR codes for online payment is very secure. As QR code is nothing but just a tool that is used to exchange information, data that is transferred via QR codes is encrypted. QR code payment solutions minimize data loss and security breaches.

Easy to set up:

Setting up QR code payments is extremely easy. There is no need for any additional overhead cost or infrastructure to set up a QR code. QR codes can be simply printed on paper and can be used for scanning and payment.

You don’t need much of an infrastructure. Payment acceptance via QR code also eliminates the requirement of any third-party application or physical device like POS.

Extremely reliable solution:

QR code payments are a foolproof payment method as it eliminates the probability of any kind of error. The pattern of black boxes consists of unique data which enhances the reliability of the QR code payments.

How can small businesses receive Digital payments

Online payments and small business How can small businesses receive payments online? The question remains popular despite the launching/...

How can Merchants Accept QR Code Payments?

Merchants can accept online payments via QR codes by setting up acceptance/service through payment companies offering processing services via mobile applications.

In the case of online stores, merchants can accept QR-enabled payments as long as the payment gateway supports QR code applications.

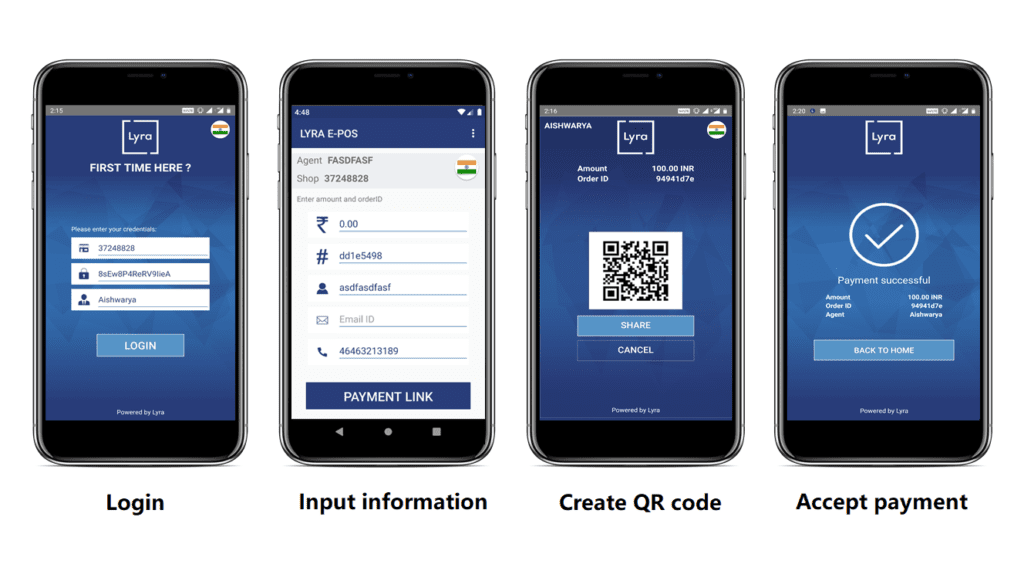

With these three simple steps, you can start accepting QR codes Payments quickly:

STEP 1: Download the Lyra EPOS application

STEP 2: Register Yourself

STEP 3: Start accepting payments

With Lyra’s EPOS application you can generate QR codes without a hassle by inputting minimal information.

This user-friendly app is tailor-made for all types of businesses.

Its user-friendly interface makes it easy to accept online payments and track them.

How to generate a QR code for payment?

QR code payments Use Cases?

QR codes offer easy payment solutions making it suitable for all types of businesses. Here are some QR payments use cases.

In India, more than 9 million merchants allow payment transactions via QR codes, and taking a look at the number of benefits, more would opt for it.

Utility bill payments:

QR codes are changing the bill payment scenarios.

Vendors providing utilities like water, gas, and electricity are embedding QR codes in bills and without even opening the bill, customers can just scan the code and proceed towards payment.

Reasons Retail Businesses should use EPOS App

Reasons Retail Businesses should use EPOS App Having a retail business means, you consider keeping your business up to date so as to keep up with...

Restaurants:

QR codes are often placed at the checkout counters. But with the digitization taking over, now customers can have a very digital experience from the menu, ordering food, to pay bills as QR codes are often embedded in the digital tablets restaurants use.

Vendors, small merchants, SMEs:

Despite the business size, online payments via QR codes can be accepted anywhere. For small merchants and street vendors, it helps reduce overhead costs, in other cases, nowadays, most of the QR-based app gives insights, analysis, and much more functionalities that can be useful from business perspectives.

Other than mentioned businesses, QR codes are also used at fuel stations, parking, e-counters, ticket bookings, freelancers, etc.

Boost Your Business

Let us help you find the perfect Payment Solution