What is the role of a payment gateway and what is its success rate in India?

A payment gateway for an online business is extremely imperative since it is a channel for receiving transactions on an everyday basis.

Providing the services to receive an endless amount of payments, securely, quickly, and conveniently, a payment gateway also aids in multiple related tasks.

Be it storing the customer details for future tracking or increasing your customer satisfaction with smooth payments, it embraces it all.

As the role of a payment gateway is mainly to authenticate transactions between you and your customers, without it, an online business remains incomplete.

Payment gateway services are needed for all online credit card processing and work with the exact procedure a Point of Sale (PoS) device does when you pay for your meal at a restaurant or for a product at a brick-and-mortar retailer.

Hence, the main role of a payment gateway is to assure and secure the transactions for you on an everyday basis.

Hence, without a payment gateway, the transaction process cannot go forward and the merchant cannot receive the due amount.

Considering the importance of this channel for the online businesses, apart from the main role of authorizing the transactions, a payment gateway further performs some important functions:

- Payment gateway stores customer details securely for future reference

- Accepts various payment methods

- Flows the transactions safely

- Maintains an uninterrupted channel for sending amount from cardholder’s bank account to acquirer’s bank account

- Enables an easy way of making payments

Payment gateways are validated to authenticate the customers (to perform their major role)!

Further, it is imperative to note that the Payment gateways are validated by the certifications like EMVCO 3D Secure and PCI DSS for being able to authenticate the customers efficiently.

Making payment gateways secure and reliable, these certifications can be explained elaborately as:

- Payment Card Industry Data Security Standard (PCI- DSS): It is a security standard, which is mandated by Payment Card Industry Security Standards Council to reduce credit card frauds. This compliance goes through validation on an annual or quarterly basis. Following the validation, a report is created based on the volume of transactions of the organization.

- EMVCO 3D Security 2.0: In order to increase the security for those who deal in e-payments on an everyday basis, EMVCo 3D Secure 2.0 came into existence. Broadly, it is an organization made up of six major card networks and is an improvisation over several shortcomings of 3D Secure 1. With the power of better authentication and an exquisite user experience, it helps merchants deal in extremely secure transactions.

Consequently, the process of the transaction flowing from the cardholder’s account to the merchant’s account is firmly secured by the relevant compliances and a regular follow-up on the same.

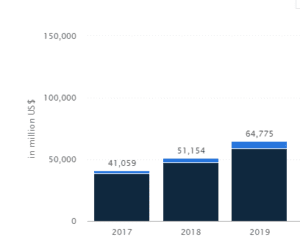

Inevitably, the success of the payment gateways in performing their roles is vividly visible in the number of transactions that have gone up over the past three years in India.

Supporting the statement is the statistical data below that confirms the same:

Source: Statista.com

Follow Lyra India for more updates